|

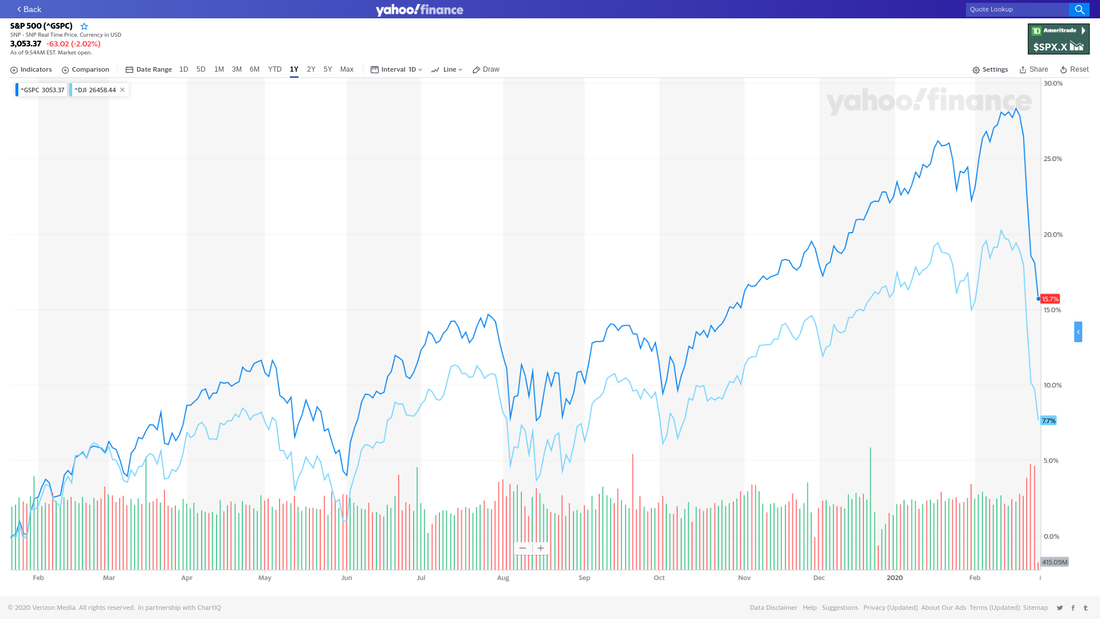

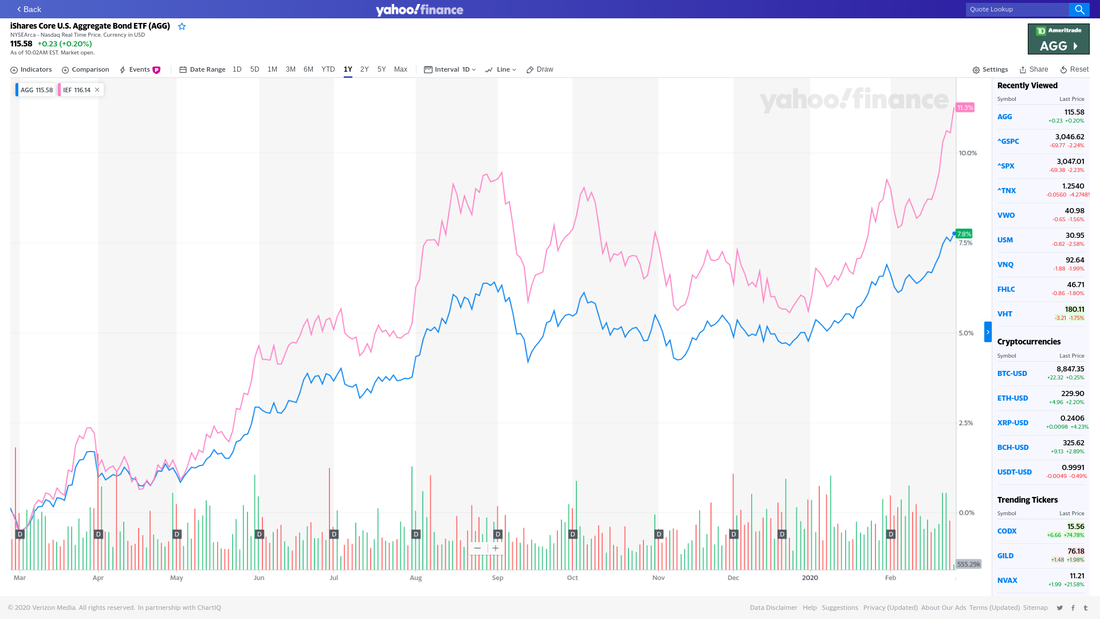

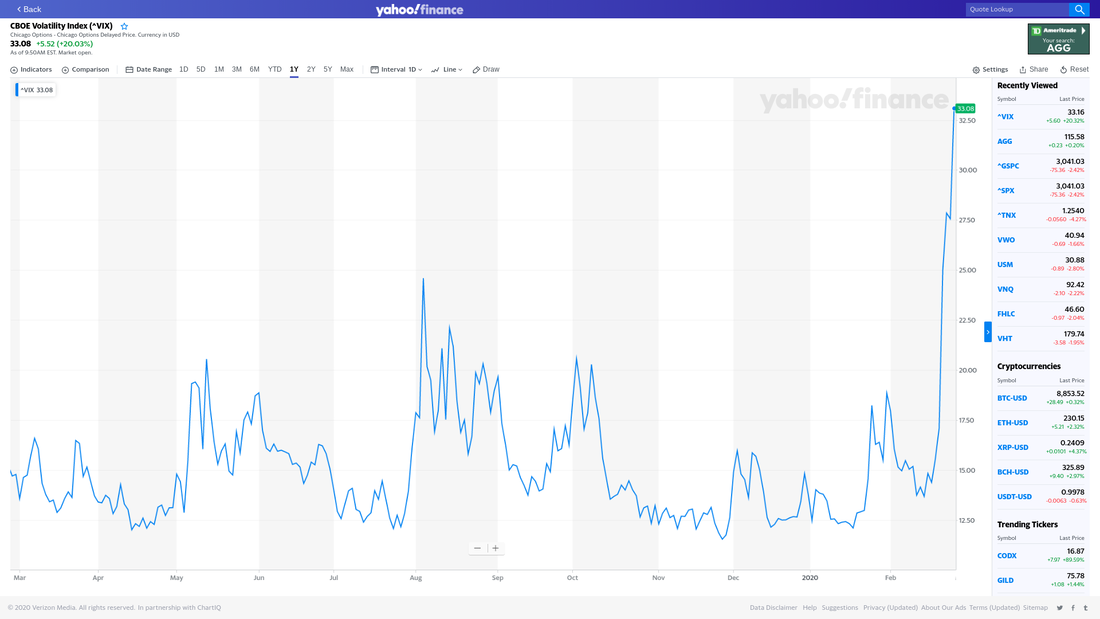

2/27/2020 Brief market commentary - going viralAs of 10am this morning, the US stock markets look headed for another significant drop. The Dow Jones Industrial index is down more than 1.5% on the day, bouncing between -450 and -650 points, depending on when you look; the S&P 500 is down almost 2%. This is a chart showing those two index levels over the last 12 months: The numbers in the chart may be hard to read -- they show that current prices versus a year ago are still "up", with the Dow and S&P showing gains of 7.5% and 15.5% respectively for that period. The next image shows the price movement for two bond funds for the same period, one tracking a wide variety of bonds, and the other a tighter selection of US government bonds of intermediate term: Those investments ALSO show significant gains for the period, and show the effects of a "flight to quality" i the last few days as the stock market volatility has ramped up. And speaking of volatility, here's a look at the VIX index, which represents one measure of market volatility: The recent spike is moderately higher than similar spikes in February and December of 2018, but still less than half the levels seen in 2008 during the "crisis". So, what's happening and what should investors do about it?I will continue to refrain from suggesting that I know with certainty the "why" of any given event in the markets, but I'm comfortable assuming that this activity has at least some source in the Coronavirus news. The value of any given stock relies implicitly on that company's likelihood of realizing profits, and the market trying to assign a "present value" to a future stream of those profits. When something happens to introduce increased uncertainty about those profits, the market reacts by widening their range of assumptions, and essentially by design tend to "overshoot" the estimates for how bad (or good) things may turn out.

Because this particular virus is "new", and we don't know precisely how widely it will spread and how disruptive the spread will be to different parts of the economy, large market participants are reacting by dramatically widening their math on future profits. When more information comes in, the market will likely tighten their assumptions again and the market will settle into a more stable range of prices; what we don't know is if that more stable range will be higher/lower/similar to where we were just before the virus hit. For my own investments, and those I manage for my clients, my intention is to maintain a risk appropriate posture; for goals with "long" time horizons, like retirement 10 or 20 or 30 years out, I will continue to hold portfolios weighted to stocks, with a smaller allocation to bonds, cash, etc. For shorter goals, I will continue to hold bonds, cash, and short term instruments in incrementally higher proportions to constrain the overall portfolio volatility. This week and next I will look for opportunities to tactically realize "tax losses" if they are valuable to my clients; I will review if specific index tracking funds performed as expected; I will use cash flows from dividends and interest to make tactical reinvestments; and I will rebalance portfolios that have drifted away from the client's designated plan. |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed