|

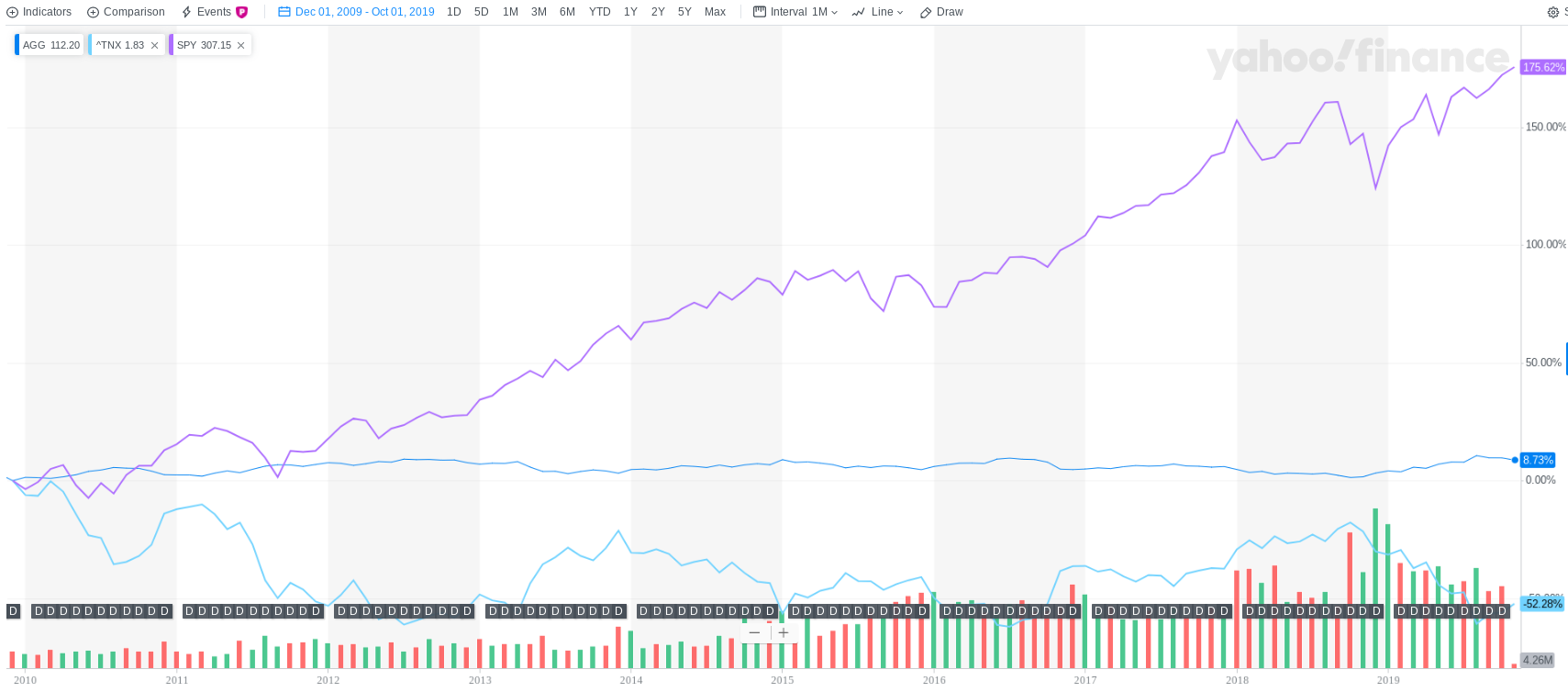

11/5/2019 Guessing about the market's futureIt is apparently the season when the big investment banks announce their assumptions for how the market may perform over both the next year and the next decade. Both Morgan Stanley and JP Morgan have recently released their forecasts, and I want to take the opportunity to share my views and how DRW Financial intends to work with our clients’ investment needs both now and later. We know that it is a fraught exercise to try to predict the future with any certainty, no less so when discussing financial markets. With that in mind, I read posts like these from JP Morgan and Morgan Stanley as “informed guesses”, and try to recognize that those firms need some baseline estimates in place to inform the work they do. We also need baseline estimates to help us build portfolios that have a chance of matching up with our clients, their needs, and their goals. Both JPM and MS are offering fairly constrained guidance for the next 10 years or so, and both focus their explanations on a typical “60:40” portfolio, meaning an asset allocation with 60% of the funds holding stocks and 40% holding bonds. Morgan Stanley’s guess is that this type of portfolio would return approximately 4.1% on average, annually, and JP Morgan puts their number a bit higher at 5.4%. It is worth noting that both numbers are significantly lower than the average over the last 10 years (roughly 10% per year average return on an inflation adjusted basis) or 20 years (roughly 7.2% on an inflation adjusted basis). The context and “why” of these forecasts may be useful, as well. We find ourselves in a situation where stocks AND bonds have performed pretty well over the last 10 and 20 year timeframes. Since November of 2009, stocks (as represented by the S&P 500 index) have risen about 175% in total, bonds (as measured by the AGG “aggregate bond fund”) have risen about 8% total on price, in addition to their income distributions, and interest rates (as measured by the 10 year treasury yield) have fallen by about 52% — when interest rates fall, bond prices rise. Part of what goes into these market forecasts is a guess about whether trends can continue or not — while there is not technically a cap or ceiling on stocks and their ability to continue to rise, history has shown us that “corrections” occur with regularity (a “correction” is defined as a 10% or greater decline in stock prices); with bonds, there is a more natural cap or ceiling on price increases, as yields approach ~ 0%. So what do we think here at DRW Financial, and how are we preparing for the next market cycle? We start with a dose of humility, and recognize that we cannot know precisely what the market will bring. We follow evidence based best practice in advising clients, not only on their investment choices, but also about their broader approach to financial security. We choose an asset allocation mix that suits each client’s tolerance for risk, and that matches their specific goals. We fill that asset allocation with low cost and well managed index funds, and we rebalance and evolve both the allocation mix and fund choices over time as the client’s situation changes and better fund options become available. To optimize for whatever the market brings, we pay attention to the way our asset allocation choices interact with each other (specifically via correlation, or the way two assets tend to move together or not). We prefer to avoid high correlations within our portfolios so that a shock in one part of the market does not pull the whole portfolio down. We seek to diversify not only by asset class (stocks, bonds, real estate, etc), but by geography and underlying currency and place within the market (think “small cap” vs “large cap” stocks, or “developed” vs “emerging” international economies). And then...we wait and see. If the market does great, we adjust. If the market does poorly, we adjust. If an opportunity arises to take some measure of risk “off the table” and still meet the client’s goal, we do so. So whether the market rises by 5% or 10% next year, or falls by 20% or more, we have a plan in place designed to match the needs of our clients, and informed by the experience and best research we can find. Resources and references:

A CNBC story about Morgan Stanley's forecasts JP Morgan release on November 4, 2019 titled "Long-Term Capital Market Assumptions Executive Summary" 10 and 20 year "60:40" data generated at PortfolioVisualizer.com Would you benefit from converting some of your “traditional” retirement savings (think 401k or IRA) into a ROTH type IRA? An overview of the strategy may be useful in making your own determination. Traditional vs ROTH -- what’s the difference? Contributions to a traditional IRA (or 401k, 403b, 457 plan…) have to potential to lower your taxable income in the year of the contribution, and may defer income taxes on gains while held inside the account. When the funds are withdrawn, they are typically taxed as income at your marginal rate, and if funds are withdrawn before age 59.5, an additional 10% tax penalty may be assessed. In contrast, contributions to a ROTH are made “after tax”, and so receive no income tax benefit in the year of the contribution. Taxes on gains are deferred as with traditional IRA balances. But when funds are withdrawn, after age 59.5, there is no income tax due. Let’s talk about RMDs a bit. The government may be OK deferring income taxes on retirement savings, and offering a tax break in some cases when funds are contributed, but they definitely prefer to get to tax that money eventually. For traditional IRA (and 401k, etc) balances, “required minimum distributions” begin when you turn 70.5. There is a standard calculation that uses the last year ending balance of your funds in all of your traditional retirement accounts and your current age, and kicks out a number that MUST be withdrawn from your accounts and subjected to income taxes. Failure to meet your RMD comes with stiff penalties on top of the regular taxes. Because ROTH balances are “after tax” already, they are not typically subject to RMDs. Why would someone convert to ROTH? The rationale to convert some or all of your traditional retirement savings to the ROTH style will depend on your particular circumstances. Some reasons that may be compelling:

Some Practical Considerations

DRW Financial provides financial planning services and investment management to clients

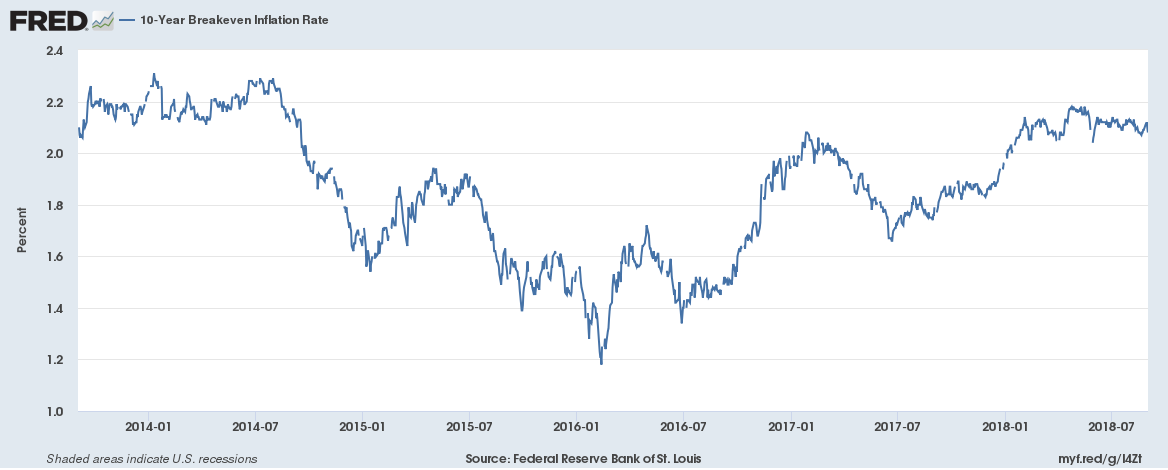

per agreement. DRW Financial does not provide professional tax or legal advice, and recommends that people engage a tax or legal professional prior to taking action. 9/11/2018 Insights from the bond marketMany investors recognize that the bond market provides an opportunity for asset class diversification, but what may go unappreciated are the insights that bonds can provide for investments in the stock market. There are three data points in particular that can be useful for investors building portfolios in stocks. Inflation crossover rate The actual rate of inflation that an investor experiences over their investing timeline has enormous consequences for their economics; at a minimum, investors hope and plan for a return on their money that matches inflation to maintain their purchasing power. When making return projections for a given investment goal, like retirement savings, it generally makes sense to apply an assumption for the rate of inflation over that period. Investors can use historical inflation data, or the most recent measure, or can make a guess about what is likely to happen in the future. When making a guess about the future, the bond market may provide a helpful insight. The “breakeven rate”, which measures the difference in yield between a point on the yield curve between traditional treasury bonds and inflation indexed treasury bonds, captures in one number the bond market’s anticipated inflation for that period. This image shows the breakeven rate at the 10 year spot on the curve: Federal Reserve Bank of St. Louis, 10-Year Breakeven Inflation Rate [T10YIE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10YIE, September 5, 2018 The most recent value of 2.08% suggests the bond market currently believes that to be the likely annual inflation rate over the next ten years. Risk free rate Approaches to valuation for stocks like the Capital Asset Pricing Model and mathematics to analyze options like the Black-Scholes model require an input for the “risk free” rate. Investor preference can dictate what rate they choose for this purpose; the 3 month T Bill rate is often useful due to the regular supply via Treasury auctions, the minimal duration risk, the high liquidity, and the full backing of the United States government credit quality. Board of Governors of the Federal Reserve System (US), 3-Month Treasury Constant Maturity Rate [DGS3MO], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS3MO, September 5, 2018. Viewing the change and volatility in the chosen rate over time can also help inform expectations for the stability of the model. For example, in the CAPM calculations, a 3 month T Bill rate at 1% implies a very different value for a subject stock than the same rate at 2%. Shape of the curve The “yield curve” is made up of treasury bills, notes, and bonds with maturities ranging from a few days to as much as thirty years. The historically normal shape of this curve slopes upward, with the shortest bonds showing yields that are relatively lower than bonds with longer maturities. There are different theories for why the curve is normally shaped in this way, with implications for investor preference and opinions about risk, but for decades the typical relationship between spots on the curve is that longer maturity bonds yield more than shorter, with the amount of difference rising and falling over time. When the curve deviates from the historical norm, and either “flattens” to where there is little difference between the yields at different spots on the curve, or “inverts” to where shorter rates yield more than longer rates, there may be serious implications for the economy and for the stock market. The image below shows the 10 year treasury rate minus the 2 year treasury rate for the last ten years. Over that period, the spread between the two has bounced around a considerable amount, and in the last few months has shrunk to about 0.25% Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10Y2Y, September 4, 2018.

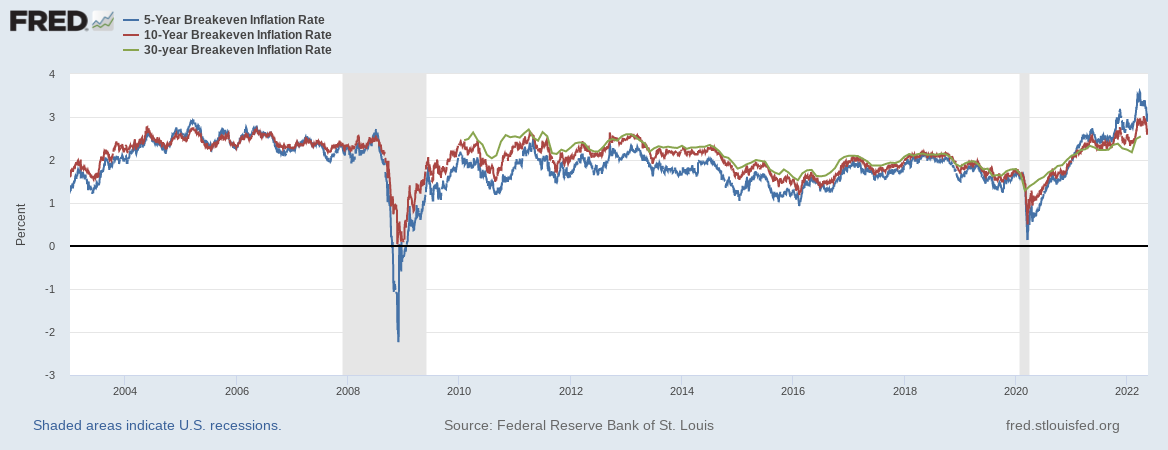

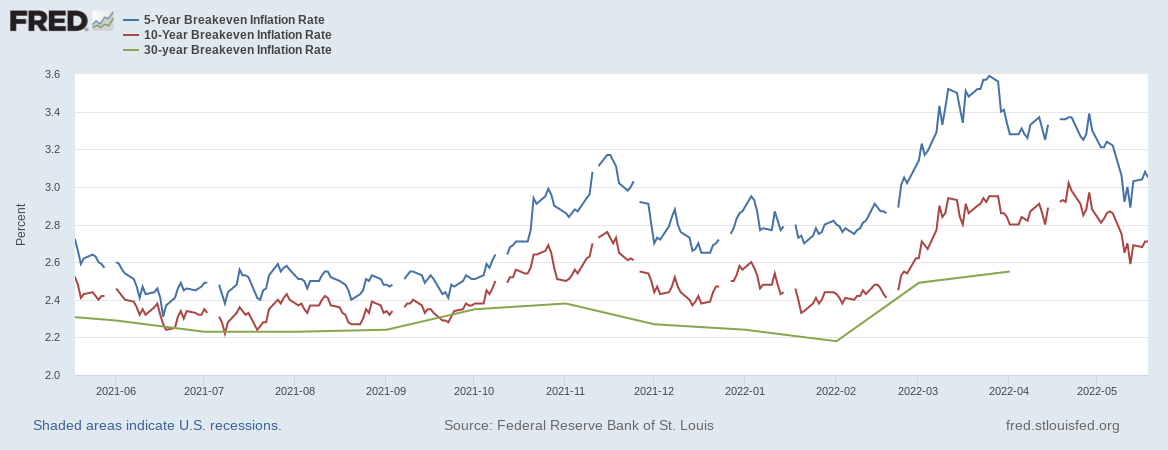

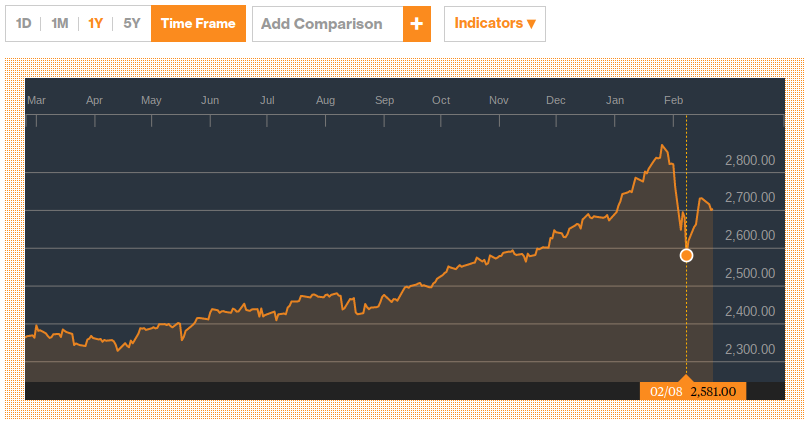

Market participants may read many portents into a flattening or inverted yield curve. Some common concerns are that a curve that deviates from the norm in this way suggests that a recession is likely in the near future. A more concrete view is to consider how the actions of the Federal Reserve propagate out through the bond market. In the recent case, the Fed has raised their funds target several times, which led to the short end of the market rising too (see the 3 month Bill rate above). The points on the curve further out, such as at the ten year and thirty year spots, have not yet priced in the likelihood of higher inflation or the Fed funds target to sustain in the current range. So the short end yields are up, but the longer yields have risen less on a relative basis; this leads to a flatter curve. Notes and disclaimers The Federal Reserve Bank of St. Louis provides an excellent resource for economic data; the charts and figures for this article are all sourced from FRED. This article is intended for educational purposes only, and is not a solicitation to buy or sell any security or investment. Investors should consult with a qualified professional, and carefully consider the risks and potential rewards of any investment strategy prior to making an investment. 2/23/2018 On inflation, stocks, bonds, and cashWhy did the market "go down" in late January, 2018? There are many possible reasons, and most of the time a substantial move in the market is really about a combination of things (if there is any real reason at all). My current vote for the "biggest" reason for this particular fall in the price of stocks is what was happening in the bond market, which was itself reacting to what was happening with the Federal Reserve policy, which was itself...complicated. Inflation always matters...sometimes, it matters moreIn brief, the Federal Reserve in the United States has a few main purposes, which are often reduced to the "dual mandate" of promoting employment and moderating interest rates. The entire financial system relates more or less directly to the cost of money over time (aka interest rates), and inflation is a major consideration in how the markets set appropriate interest rates for a given investment or transaction. Again, speaking in simple terms here, for an investment to yield an economic gain to the investor, the realized return must be greater than the rate of inflation for the same period. If not, the investor is actually losing "purchasing power". For example, if I have $1 today and a can of soda costs $0.50, I can buy two cans. If I wait a few days, and the price of the soda rises to $0.55 but my $1 is still just $1, I can no longer buy two cans...the purchasing power of my dollar has eroded due to inflation. In January of this year, two things seemed to come together to jolt the market: (1) the major US stock indices were setting records for the longest period without a "correction"; and (2) the Chairwoman of the Fed was stepping down and aside for her successor. My view is that these two factors were causing the market to process what might happen with inflation, both from pressure of a "hot" stock market, and from the relative uncertainty as to how the new Chairman would respond to that pressure. The US has enjoyed a very long period of relatively tame inflation, and the prospect of a quicker increase in consumer prices can be unsettling. Investment options in an inflationary period?For investors (which includes normal folks looking to properly manage their retirement savings), the task of how to best position themselves in a period of rising inflation can be challenging. Here are a few points to consider:

Time to review with a pro?Let's get two things out of the way early: (1) there is a lot of noise in the news right now about Bitcoin and its crypto-cousins (and too little information, in my humble opinion), (2) this post is a contribution to the noise, but hopefully contains a little information relevant to my client base and readers. the briefest of summariesThere are plenty of articles going around about what crypto currencies are supposed to be, and how blockchain technology is meant to work, so I will keep my comments on this aspect super brief. The blockchain is sometimes referred to as a "distributed ledger" for financial transactions, which can in many ways bypass the existing infrastructure of banks and payment processors and clearance / settlement facilities currently involved in exchanges of value between parties. And while this ledger is maintained and processed in a relatively "public" way by market participants, individual participants are able to act in a relatively anonymous way. Bitcoin is a medium of exchange on one version of blockchain, and it follows a very specific protocol or set of rules about how new Bitcoins can be introduced to the market and how transactions in Bitcoin between parties can be processed (this activity is collectively referred to as "mining"). Bitcoin itself has "forked" into some new variants that have expanded or refined protocols that attempt to address some perceived challenges with actually using a crypto currency, and there are also different approaches to the blockchain that support other coins, like Ether on the Ethereum network. so, should you own some?Chances are decent that you are more aware of Bitcoin and its brethren because the prices of crypto currencies have risen so dramatically in the last year; it is a basic function of a "bubble" or hot market that big gains in value attract attention, which inspires a desire to participate, which pushes prices higher, which causes the cycle to repeat...for a time. So are crypto currencies in a bubble? Sure. Is that "bad"? It depends on your perspective. The primary aim of this post is to offer a framework for considering an individual investment in Bitcoin or one of the other coins, so I will pivot to that:

too long, didn't read? (tl;dr)Everyone's talking about Bitcoin and the other so-called "crypto currencies". Much of the present attention seems to be driven by a fairly typical "fear of missing out" bubble. Investments in crypto coins have both idiosyncratic and traditional considerations for investors. Proceed with caution!

Current and prospective clients of DRW Financial should feel free to email or call David with questions on how or if it is appropriate to incorporate an investment of this sort within their overall plan. 11/27/2017 budget trouble? check your egoMany of the posts I write are as much for me as for anyone out there looking for new insights on their financial condition. Today's is one such post. I have written elsewhere about how our money choices reflect on our values, and that when there is conflict between what we say we value and how we live our values, there is an opportunity for self-reflection and a choice to align the two. you probably don't need that...But where does ego fit into this discussion of values and money? One example within my own budget and experience involves technology, specifically smartphones and computers. I use an Android based phone and a Chromebook for my work and personal computing needs. These choices were originally at least a bit driven by economics: iPhones are expensive and in the early days just having an iPhone required a specialized phone plan that cost more than average; similarly, a decent Chromebook costs around $200, while a similarly featured Windows machine might cost twice as much (or more), and a Mac might cost 3x - 4x just to get started. But even though I may have started out with fiscal discipline in mind, what happened over time is that at each opportunity to replace or upgrade my equipment I would inevitably spend some time looking at the "nicer" options available. A $200 Chromebook has proven to be sufficient, but the $600 one may be prettier and have some snappier specs... The $150 - $200 "mid range" Android smartphone does 95%+ or more of what the current "top end" phone may offer, but there is always that voice in the background saying "wow, that fancy phone is cool!" Examine, don't justifyThis is where the budgeting rubber meets the road. When faced with an option to spend more or less for essentially the same experience, it is crucial to be honest. When explaining (to yourself or others) why you want the more expensive option, choose to have enough perspective to examine those reasons objectively. It is so easy to justify a choice that we want to take, but it can be hard to be honest about the quality of those justifications.

Shopping while under the influence of vanity or with a heightened sense of your needs can lead to some financially unsound decisions. 3/23/2017 who needs investment management?Some folks don't have any investments. Others are in a situation where their circumstances dictate a very "keep it simple" approach. But for much of the rest the population, there may be value in working alongside a professional investment manager in pursuit of an "optimal" investing approach for their specific needs. we follow a fee-only, "fiduciary" approachDRW Financial offers investment management solely on a fee-only basis and as a Registered Financial Adviser. This means our only compensation comes from providing advice, not by commissions on transactions. We believe this allows us to offer that advice with fewer conflicts of interest and to act as a fiduciary for our clients. do you have...?

These are a few examples of issues and areas where we have helped others improve their understanding and their approach to investing. DRW Financial works with artists and engineers, physicians and educators, "millenials" and retirees. are we a fit?For a quick and "no cost" consultation to evaluate our "fit" for working with you on investment management, email David@DRWFinancial.com

3/23/2017 do you need financial planning?"I don't have any finances to plan"I hear this pretty regularly. And I get the humor. The reality is that there are valuable opportunities for most people (or families) in going through the process of financial planning. And it is a process; done well, this process can lead to some very positive outcomes:

DRW Financial offers financial planning services on a flat fee basis. This means that there is an agreement upfront to address a given scope and scale of planning, and a stated fee that covers a full calendar year of work and revisions to that plan.

3/20/2017 estimated tax payments?For many people, paying income taxes is something that happens "automatically" with every paycheck, via the mechanism of payroll deductions. Line items like Social Security, Medicare, and an approximate amount of income taxes owed come out of each paycheck, and the process of completing and filing a tax return in April of the next year results in a reconciliation of that process: did the taxpayer pay "too much" or "too little" over the course of the year, and do they get a refund or a bill for taxes due? for the self-employed, and...But for folks who earn income "on the side" or are self-employed, payroll deductions are far less common. For many people in this scenario, the typical approach is to pay "quarterly estimated taxes" via the IRS form 1040 ES. The general idea here is that the taxpayer will figure out what they are likely to owe for the full year, and make four equal payments by the quarterly deadlines. In reality, for many self-employed people their income does not come in conveniently steady streams, and accurately forecasting their full year income can be difficult. For people in that situation, it may be necessary to make adjustments along the way to get the cumulative tax payments close to the right amount. "gig economy", "side hustles", investments...Even for people who get most of their regular income from a salary or W2 paycheck, there may be a need to consider making 1040 ES payments. Drive Uber for extra cash? Rent out a room on AirBnB? Realize some significant investment gains? All of these could potentially raise the tax liability for the year; if the amount paid in along the way is too low, there could be a penalty in addition to the eventual tax owed. the next due date: april 18, 2017If any of the above applies to your situation, get ready for the first 2017 quarterly due date in mid April. If this date seems familiar, it's because that's the 2016 personal return filing deadline too!

3/20/2017 social security insightsIf you belong to the portion of the population aged 60 or older, you have probably given a good bit of thought to Social Security; if you are much younger than that, the concept is probably not high on your current list of priorities. But as a financial planner and investment adviser, I routinely find that the various benefits available via the Social Security Administration are an important and often misunderstood part of folk's financial picture. it's your money, coming backOne thing to understand upfront is that almost everyone earning income in the United States pays a tax into the Social Security fund throughout their earning years. Although Social Security benefits are sometimes described as "entitlements" in a way that suggests otherwise, the money that retirees get back comes primarily from their own contributions and those of their peers and the generations preceding / following them. spouses and kids can benefit, tooSome of the benefits available via Social Security are available to spouses and children of the income earner who paid into the system. For instance, in a two parent household if one worked outside the home for a wage and the other spent their working years raising kids and caring for the home, the one without an income history may also qualify for a retirement benefit based on the contributions of the working spouse. check your benefits early and oftenThe Social Security Administration offers a couple of tools that are really very valuable for gaining a basic understanding of where a given person stands in relation to their potential benefits.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed