|

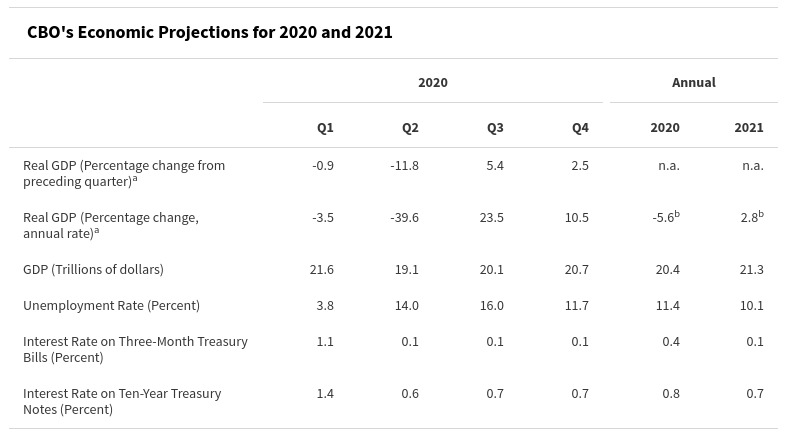

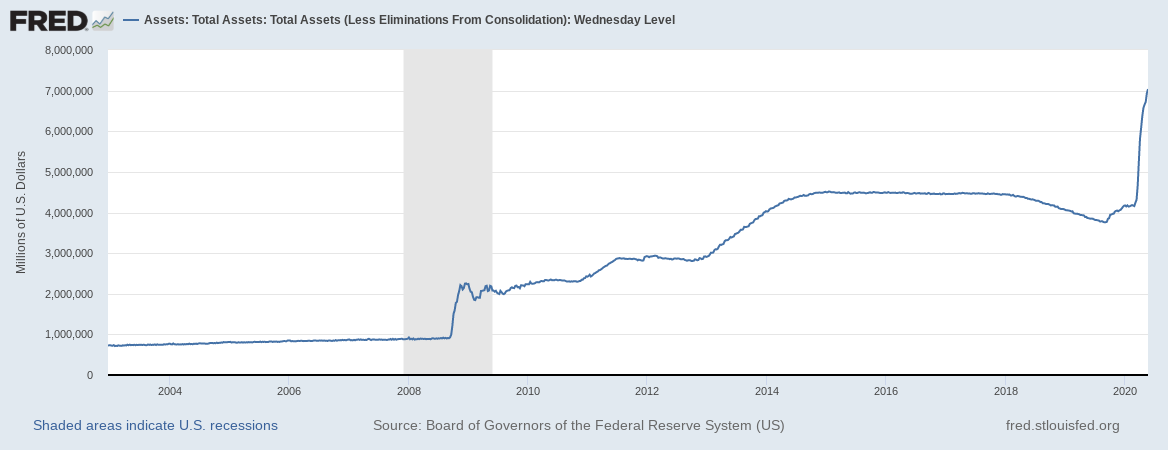

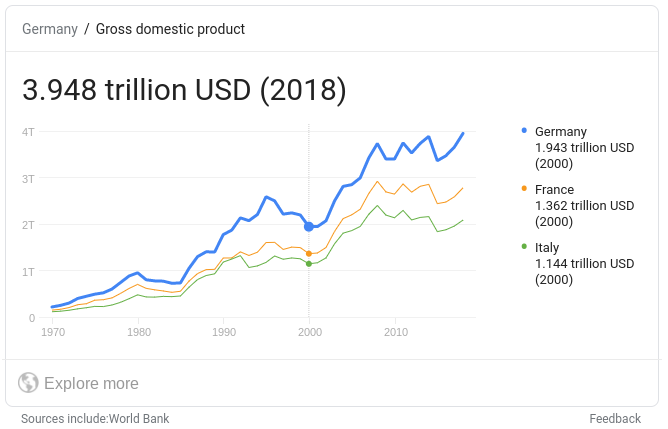

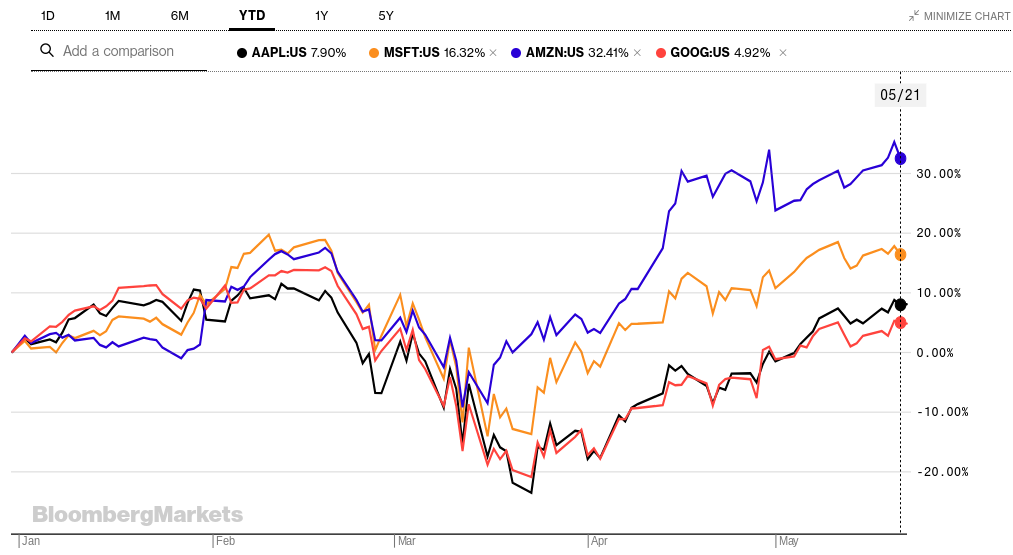

5/22/2020 May 2020 updates and insightsIt has been a bit since I have collected together my thoughts and observations on the market, the economy, and implications for financial planning best practice. Some of this post will get technical and long winded, so I will try to capture the headline level here at the top. Market volatility is [probably] not overAs of this writing, the S&P is still about 14% below the market highs in mid February, and about 9% below the start of the year. That reflects a remarkable "bounce back" from the lowest numbers in March [approximately +31% from March 23 to today]. As a participant in the markets as an investment manager and investor of my own funds, I certainly appreciate this bounce. But I retain a significant amount of skepticism about the economics underlying the market. So if there is a prime takeaway from this post, it is that I expect additional volatility in the weeks and months to come. I will stay invested and will counsel my clients to stay invested, but in a posture that reflects the economic reality and in line with each person's specific goals and tolerance for risk. Now, to the data, observations, and insights. The economy =/= the marketThe Congressional Budget Office is projecting significant contraction in the US economy through the COVID 19 pandemic. The Q1 numbers are already behind us, and the projected drop in GDP to NEGATIVE 39.6 is expected to lead to a negative real growth rate for the year of ~ 5.6% Against this backdrop of expected economic contraction, the stock market (at least as represented by the S&P 500 index) has regained a lot of ground lost during the "shut down". If you dial out the perspective to a 12 month or longer view on the index, returns are now positive -- from May 22, 2019 to today, the S&P is up about 2.75%. This disconnect between the market and the economic data can be jarring and confusing, and often leads to the invocation that "the market is not the economy". They aren't the same, but are related. Stock market investors are generally assumed to be buying into a share of future net income from the companies they choose to own. The earnings from any given company can diverge from the broader economy in the short term, and for a very limited number of companies that diverge could persist for a while, but my expectation is that over time, the valuation of a company's stock should reflect the economy that they operate within. Why is the market "going up"?I will continue to maintain a humble awareness that I cannot know anything for sure about the present or future state(s) of the financial markets, but I can make some informed guesses about pieces of it. It is a reasonable question to ask: if the economy is really hurt, why would the stock market go up? From where I sit, there are two primary drivers of the index valuation since mid March: cash from the government (& Fed), and outsized index constituents. This chart shows the "balance sheet" of the Federal Reserve going back to the early 2000s. The shaded bar covers the period of the "financial crisis" or "Great Recession", and that sharp uptick in the chart was when the "bailouts" and "quantitative easing" and other financial interventions happened. The Fed's balance sheet doubled in that phase, from just under one TRILLION dollars to more than two. The Fed remained invested in the market at elevated levels, creeping up over time to about $4.5T, and then in March of this year jumped about 75% to ~ $7 trillion. We throw around big numbers a lot in discussions of financial markets and the economy, so it may help to put ~ $2.5T to $3T in context. The image below shows the (2018) GDPs for Germany, Italy, and France: So far this year, the Federal Reserve has injected cash to our economy roughly double the entire GDP of France (and 3/4 of our own GDP from 2018). For another comparison that also leads to my next point, the largest companies in the US are all grouped roughly around $1T in "market capitalization". Apple, Amazon, Microsoft, and Google are all valued at +/- $1T in the current market -- the Fed pumped the rough equivalent of two to three "Googles" into the economy in a matter of weeks. Those four stocks also play a role in my understanding of the current index valuation. I will focus on just one as an example here, but all four are shown in the chart below. Microsoft is up more than 16% year to date, maybe because people are relying more on their cloud products during "work from home" or buying Xboxes or whatever. The WHY is less important than the WHAT for the moment. At present, MSFT makes up about 5.6% of the whole S&P 500. In a overly simplified calculation, about 90 basis points of the S&P's return for 2020 so far comes from Microsoft. If you took MSFT out of the index, instead of the S&P being "down" about 8.9% on the year, it would be down about 9.75%. Apple, Microsoft, Google, and Amazon are the largest components of the S&P, and all are up big over the last few months, and up even more over the last year. Removing their contributions from the index makes the overall "stock market" returns look very different. This dynamic is one reason that my approach to investing is inclined to the use of "index funds" and away from picking or holding individual stocks for most clients. It is VERY difficult to know well in advance which small handful of stocks is going to do well in any given cycle, and marginally less hard to guess whether or not the "whole market" is going to rise or fall. For today's post, the point about MSFT et al is that they are experiencing outsized returns during the pandemic and because they are huge contributors to the index valuation, those outsized returns are propping up the "market" in a meaningful way. So what will happen next?Over the last few weeks I have been revisiting "professional" market projections from late 2019, well before the COVID 19 crisis was on anyone's RADAR. Banks and financial market participants like Morgan Stanley, Vanguard, etc all put out their capital market assumptions for the coming cycle, and the projections made in the 4th quarter of 2019 were...lackluster? Many of the projections were cautioning investors to prepare for "real" (meaning inflation adjusted) returns of less than 4% or 5% annualized for a number of years. It is entirely possible that those numbers anticipated some number of "shocks" to the economy and the markets, but I strongly suspect that none of those projections figured on a calendar 2020 with negative GDP growth of 5% to 6%. So in the context, I am trying to plan and position for subdued equity returns in the overall market, and looking for opportunities to create and realize value in that environment. I would be remiss to ignore interest rates in this discussion. Just this week, the UK issued a new three year bond at "negative yields", and the US issued a new 20 year treasury bond at about 1.2%. Overall interest rates remain at or near historic lows, and part of the Federal Reserve's growing balance sheet came through purchases of corporate and municipal bond funds, providing some pricing support (and lower yields) in those markets. While it is tempting to say things like "interest rates CAN'T go lower", that would be irresponsible and unsupported by the data. I DO tend to believe that interest rates will rise from here, but am obliged to plan for a variety of paths forward, including some version of sustained "zero interest rate policy" How to react?If you have a robust financial plan, now is probably the time to focus on executing that plan. Reviewing asset allocations, identifying tax improvement opportunities, refreshing estate planning and asset location strategies -- these may all be productive steps to take during the present "crisis". If you DO NOT have a robust financial plan, it is past time to address that gap. Whether with DRW Financial or another professional offering advice as a fiduciary, having a plan in place should increase confidence that your particular goals are addressed. My blog posts are not intended as a solicitation for new clients, or

as a recommendation to buy or sell any investment, or to follow any investment or tax strategy. They are intended to provide some educational perspective on the markets and economy. If you would like actionable advice and live in a state where DRW Financial is registered to operate, feel free to reach out via email. Comments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed