|

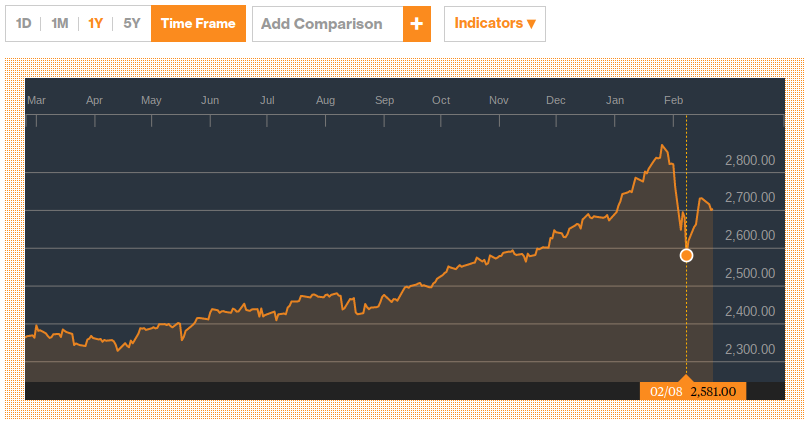

2/23/2018 On inflation, stocks, bonds, and cashWhy did the market "go down" in late January, 2018? There are many possible reasons, and most of the time a substantial move in the market is really about a combination of things (if there is any real reason at all). My current vote for the "biggest" reason for this particular fall in the price of stocks is what was happening in the bond market, which was itself reacting to what was happening with the Federal Reserve policy, which was itself...complicated. Inflation always matters...sometimes, it matters moreIn brief, the Federal Reserve in the United States has a few main purposes, which are often reduced to the "dual mandate" of promoting employment and moderating interest rates. The entire financial system relates more or less directly to the cost of money over time (aka interest rates), and inflation is a major consideration in how the markets set appropriate interest rates for a given investment or transaction. Again, speaking in simple terms here, for an investment to yield an economic gain to the investor, the realized return must be greater than the rate of inflation for the same period. If not, the investor is actually losing "purchasing power". For example, if I have $1 today and a can of soda costs $0.50, I can buy two cans. If I wait a few days, and the price of the soda rises to $0.55 but my $1 is still just $1, I can no longer buy two cans...the purchasing power of my dollar has eroded due to inflation. In January of this year, two things seemed to come together to jolt the market: (1) the major US stock indices were setting records for the longest period without a "correction"; and (2) the Chairwoman of the Fed was stepping down and aside for her successor. My view is that these two factors were causing the market to process what might happen with inflation, both from pressure of a "hot" stock market, and from the relative uncertainty as to how the new Chairman would respond to that pressure. The US has enjoyed a very long period of relatively tame inflation, and the prospect of a quicker increase in consumer prices can be unsettling. Investment options in an inflationary period?For investors (which includes normal folks looking to properly manage their retirement savings), the task of how to best position themselves in a period of rising inflation can be challenging. Here are a few points to consider:

Time to review with a pro? |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed