|

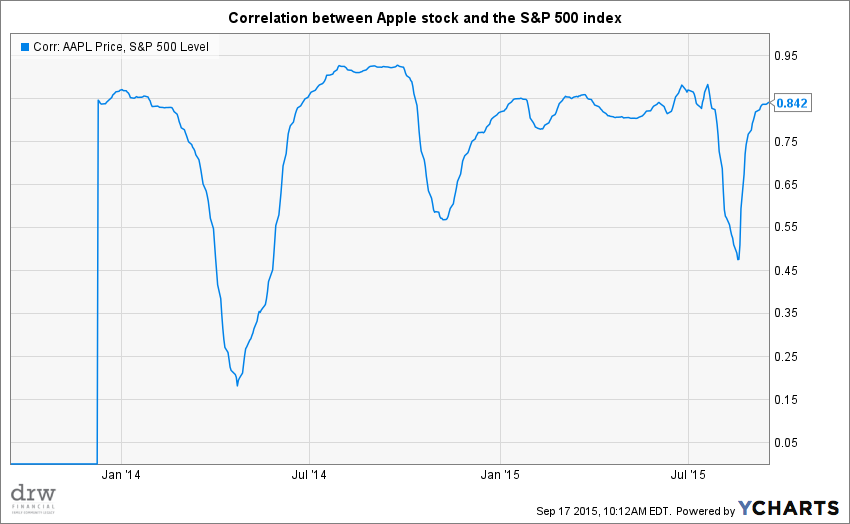

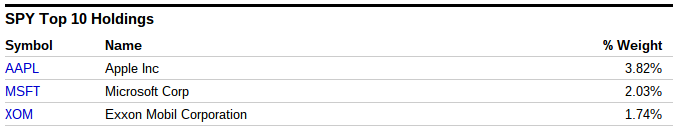

9/17/2015 brief explanation: correlationIn discussions of policy and process, there is a phrase that gets a lot of play: "Correlation does not imply causation". One interpretation of that expression is that just because two (or more) things appear to happen or appear together regularly doesn't mean there is an explicit and clear connection between them. In finance, correlation is about mathOne aspect of the scientific and philosophic approach to portfolio design is recognition that there may be some connections between discrete pieces of a portfolio, and it is important to seek those out and consider their impacts. Keeping this simple: a correlation measure can range from -1 to +1 (Negative 1 to positive 1). A correlation of +1 means that two things move together in perfect lockstep; a negative one means a perfect inverse relationship. Zero, right in the middle, suggests there is no implied or explicit relationship between the two things. In the chart above, the price of Apple's stock appears to be positively correlated with the S&P 500 for much of the last three years. don't assume too muchIn my practice, I try to look at statistical data like this with some skepticism to see if I can understand the underlying connection. If someone finds strong correlation between the height of a population and their preference for lattes over cappuccinos, I may do a little more digging to data manipulation. In the case shown above, however, it makes some sense that Apple and the S&P 500 tend to move together sometimes. For one thing, Apple is a member of that index, so Apple's movement does, itself, contribute to the overall performance of the index. Second, Apple is a disproportionately large contributor to the index. Lastly, Apple is a huge company with a large presence in the US financial markets, and large companies tend, in general, to move in sync with other large companies. zero correlation raises diversityIf the goals for a given portfolio include a need for diversity (and risk sensitive portfolios should), the designer should run some testing on correlations among constituents.

9/2/2015 turns losses into wins?

So the market has taken a bit of a downturn in recent weeks. Blame what you like: China, Greece, oil prices are all among the possible culprits, but the net effect is the same -- stocks are down. As of this writing, the S&P 500 is down 7% for 2015.

There is not much that investors can do to avoid the bumps and bounces in the market -- the reality is that if you want the full potential upside of stocks, you must also accept the potential downsides. But, that is not to say that there aren't ways to make the most of the volatility and turn some negatives into positives. Here are a few actions that may make sense in your case:

tax loss harvesting

This option is only available in taxable accounts (not IRAs, 401ks, etc). The value proposition here is that realizing a capital loss on an investment may serve to lower your tax liability in the current tax year or some future tax year.

In very general terms, an individual may be able to claim up to $3000 per year in capital losses against their taxable income; for example, a person paying taxes at a 25% marginal rate could effectively lower their tax liability for the year by $750 ($3000 x 0.25). So in a period where stock and mutual fund prices may have dropped below the initial purchase price, it may in some circumstances make sense to sell, lock in the loss, and reinvest the proceeds in another investment that aligns with your goals and risk tolerance. Be careful and cognizant of "wash sale" rules.

rebalance

For rebalancing to be relevant, there is an assumption that you followed an asset allocation plan in the first place. In simple terms, asset allocation models suggest what percentage of an overall portfolio or goal should be invested in stocks, bonds, real estate, cash, or any number of possible categories. Over time, these percentages drift from the initial targets as the market bounces and does its thing. So rebalancing can bring the percentages back in line with the plan, or can be an opportunity to implement a new plan. In either case, big dips (or rises!) in the market will typically present an opportunity to rebalance...this may look like selling some things that are up and buying more of things that are down.

add cash

Often when a person opens an account or initially funds a goal they put in as much cash as they can at the time while maintaining an appropriate reserve or emergency fund. But over time, cash may build up in a checking or savings account in excess of what may be most appropriate for a given household's needs. While many people in the market may panic in a sell off, investors with excess cash may be in a position to make a strategic new or additional entry to the market. A price that is lower than it was before is not necessarily a good price, but in some cases a broad market sell off will create valuable opportunities.

In every case, seek qualified and professional advice before taking actions with tax, legal, and financial consequences.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed