|

4/30/2013 DRW Financial ran for Emily!DRW Financial and I were proud to sponsor Emily's Power for a Cure, a Chattanooga based foundation raising funds and awareness for neuroblastoma. In addition to serving as a corporate sponsor, I had the joy of participating in the 2013 Country Music Half Marathon this past weekend as a runner on Emily's team. The day had its challenges, not least of which was a torrential, non-stop rain that turned the course into river and all of the racers into waterlogged joggers, but the day was also a success. Together, we raised over $108k for the foundation and and helped build a little more community around those families taking the fight to this cancer.

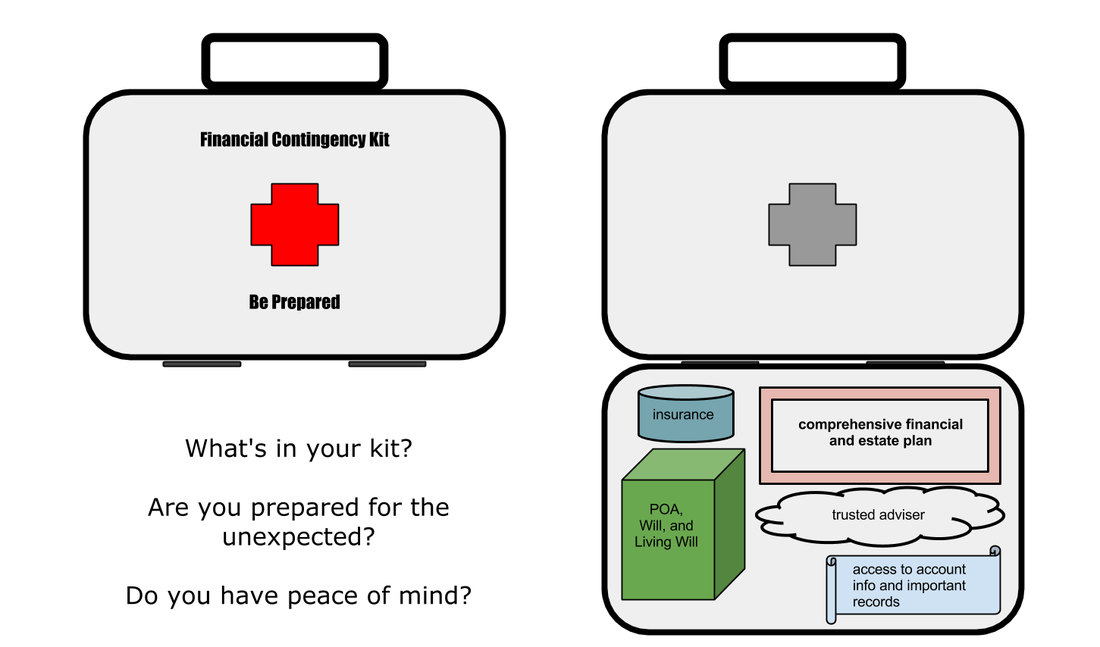

4/22/2013 Financial contingency kitBy definition, the unexpected always takes us by surprise! But there may be ways to lessen the shock and disruption to our lives by taking a few basic steps. Here are a few ideas for building your Financial Contingency Kit:

4/16/2013 Gold, in 3 charts Some weeks, it seems like gold gets more mentions in the news than pop singers and movie stars! This week, the precious metal talk has been about a big drop in the price of gold. Below are charts for the price of an ounce of gold in US dollars over three months, 5 years, and 10 years (all displayed as % change in price over that period):  Gold Price in US Dollars data by YCharts  Gold Price in US Dollars data by YCharts  Gold Price in US Dollars data by YCharts As always, there are many ways to interpret charts, and it may be that none of those interpretations capture the whole reality. A few thoughts about investing in gold:

This blog post and all others on DRWFinancial.com are intended for general education and not as specific investment advice. Additional disclaimers in the website footer apply. Many personal finance sites, as well as banks, brokers, and accounting pages feature retirement and goal planning calculators. These tools are certainly useful, but with caveats.

If a 35 year old person in the early stages of their career uses such a calculator to frame the numbers around their own projected retirement ~ 30 years later, how likely is it that the numbers turn out to be accurate? A reasonable set of assumptions to plug into such a calculation would include (not exclusively):

It should be obvious from the list that there are a lot of variables in this math! In some ways, making accurate predictions about a person's financial condition decades from now is like landing a jet on an aircraft carrier at night, in the rain, and no assistance from the control tower. This is not to say that the calculators have no value; in fact, this sort of tool is very helpful in starting deeper conversations around financial planning and managing expectations around goals. Our hypothetical 35 year old (or 45 year old!) should take the time to run the calculations, but should take care with the results...any slight tweak in one assumption or three will make dramatic changes in the final numbers. And if there is any one thing certain in life, it is that life can be very uncertain! Below the jump I will share one very simple example of how even slight volatility in assumptions can impact results. 4/9/2013 Functional Retirement?"Retirement" as a concept seems to loom large in people's minds and often dominates conversations around financial planning. Personal finance websites often feature a retirement "calculator" that attempts to put a simple number on a complex question: "When can I retire?". Stock brokers, insurance agents, and financial advisers (such as myself) run seminars and workshops on planning for retirement. Companies and the government encourage people to save for retirement in accounts with special tax treatment. Etc.

What I have found is that while visions of retirement are as varied as the population, there seem to be some consistency in assumptions for retirement math:

These assumptions may generally describe a course of action for a "typical" person, but the reality for a particular person can be dramatically different. Today I want to talk about a concept I call "functional retirement" - it's quite different from the traditional definition of retirement as described above. 4/4/2013 What's up with bonds? I spent a decade of my life hip deep in the bond markets, trading all sorts of paper and designing portfolios for clients, and I still find the fixed income world very interesting. One of the most important reference rates for the bond market (as well as the stock market, the mortgage market, the commodities markets, etc) is the 10 year yield on the US Treasury bond. Here's a look at that rate over the last 5 years:  10 Year Treasury Rate data by YCharts While the number bounced around a good bit over that time, from the low 4% range down to just below 1.5%, the trend definitely seems to be steadily lower. Below the fold, I push the chart back to cover the last 20 years.

4/1/2013 Welcome to the 2nd Quarter It's April Fool's Day and so begins the second calendar quarter. Below is a quick roundup of YTD (year to date) percentage change charts on a handful of broad market ETFs (funds that track the S&P, Dow Jones Industrial Average, NASDAQ 100, a US bond market index, and a Goldman Sachs commodity index). All show percent change year to date in price - these charts do not show "total return" including any dividend distributions. Now it is time to see what Q2 brings!

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed