|

12/18/2014 scenario analysis and planning"Financial planning" can easily describe a wide number of activities, some formal and some less so. In the course of onboarding a new client relationship at DRW Financial, we do a significant amount of data gathering and discussion around each client household's current financial condition and their assorted goals. This work builds a foundation that allows to make investment decisions, as well as to shape intentions impacting financial lifestyle, thoughts on the How & When of retirement, etc. We also do ad hoc scenario analysis to help frame a conversation around choice:

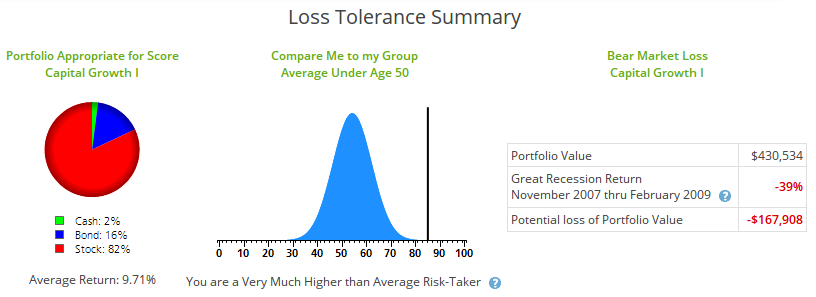

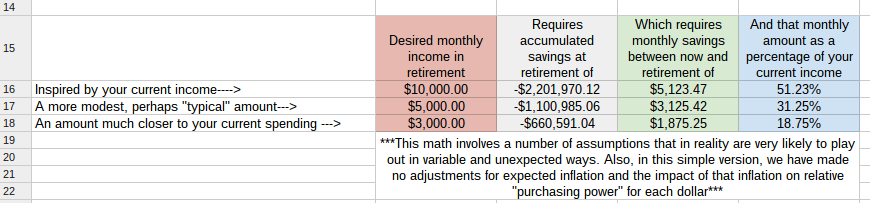

To facilitate this sort of discussion, DRW Financial applies a robust approach: We give sufficient time to discuss the ideas, and we take care to hear the questions. We work to communicate our informed experience of best practice and to outline what we see as the array of available "best options". And then we employ technology to capture those scenarios in a way that makes the relative costs, benefits, and risks apparent and available to inform the decision making process (as well as the subsequent review). One tool we use is Money Guide Pro; this platform does a pretty thorough job of calling out the typical goals and components of a traditional financial plan (sample screen shot below from the risk tolerance portion of a plan). Another tool we employ regularly are "old fashioned" spreadsheets (albeit cloud based and shared for real-time collaboration). Working through goals and scenarios in this manner can lead to a better shared understanding of the details involved in a particular approach or scenario, as well as providing a space to make all underlying assumptions very clear. The image below is from one such planning "workbook": DRW Financial's goal in each case is to truly serve each client in a fiduciary capacity, to assist them in uncovering their real values driven goals, to help them identify both the obstacles and the opportunities along the way, and to collaborate with them in creating an investment strategy best suited to those circumstances. 12/18/2014 efficient tools for clientsOne of the core values in my approach to dealing with client households is open and effective communication. From the opening interviews, through the financial planning process, and in ongoing discussions about investment objectives and evolving goals, both I and my clients are well served by a focus on communicating effectively. Two areas where technology provides significant assistance to this type of communication are:

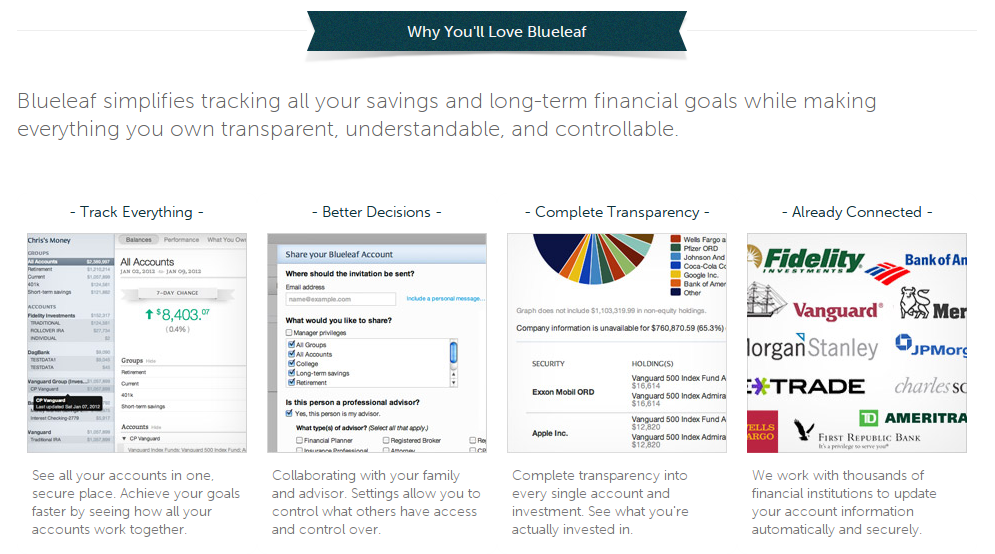

The solution we have employed for both issues is a platform called Blueleaf: Blueleaf allows for the aggregation of a client's financial data from many different sources: bank accounts, brokerage assets, workplace retirement accounts (401k, 403b, etc). Blueleaf also offers secure document sharing, on-demand performance and allocation reporting, and weekly emails with a snapshot of your financial circumstance.

Existing clients of DRW Financial enjoy this benefit automatically (if you are a client already and need a refresher on how to maximize the value of the Blueleaf platform, just give me a call). 12/16/2014 objectives and risk reviewThe end of the calendar year is a good opportunity to review, adjust, and take some actions relevant to a financial plan or investment strategy. This blog post is one in a short series examining a few of those items. The information below is not intended as formal advice for any particular circumstance, but rather a general discussion of the topic. Whether you are a "DIY" investor or someone who works with a team of financial professionals, a crucial part of the ongoing process is to review your circumstances to ensure that what you are actually doing matches what you truly want and need to be doing. investment objectivesWhile most of the talk around financial planning and investment strategy tends to get bogged down in numbers ("How much do I need to save to retire with $1,000,000 in the bank?!"), most people's objectives are actually driven by circumstance and expectations: What does today's income suggest about the ability to save for the future? What does the current standard of living imply about the desired standards for retirement years? These sorts of questions should definitely inform the initial approach to making investment decisions and/or building a financial "plan", but they are equally important for subsequent review of those plans. Circumstances, expectations, and "needs and wants" change over time; be sure that you and your financial team are aware of the current "facts on the ground". risk toleranceAs with investment objectives, a person's risk tolerance is core to the initial decisions around how they allocate their money to different types of investments. A given person's or family's tolerance for risk can be driven by many factors: age, health, capacity to weather financial "bumps", the presence or absence of financial support, and many many more. And many of those considerations naturally change over time. A family with 2 kids in college may have a risk tolerance driven by the desire to fund those education costs "no matter what"; a person receiving a substantial inheritance may feel much more secure and able to "speculate" on some investments than they did a year before they knew about the inheritance. Take some time to review your current feelings on risk and potential reward and then make sure that your existing approach to your financial goals match those feelings. values12/16/2014 tax loss harvestingThe end of the calendar year is a good opportunity to review, adjust, and take some actions relevant to a financial plan or investment strategy. This blog post is one in a short series examining a few of those items. The information below is not intended as formal advice for any particular circumstance, but rather a general discussion of the topic. DRW Financial does not provide tax advice. The following is a general discussion of one strategy available in some circumstances. Please consult a tax professional prior to engaging in any action with taxable consequence. An investor may realize a "capital gain" or "capital loss" within a given calendar year if they sell an investment at a price higher or lower than what they originally paid. Capital gains are taxed differently depending on how long the investment was held prior to sale; investments bought and sold within 12 months are generally considered "short term" and those held longer than 12 months considered "long term". Capital gains may in some cases be offset in a given year by capital losses, and the IRS may allow a net capital loss of up to $3000 to offset some amount of taxable income. Please see IRS discussion of capital gains and losses for more information. This post is primarily concerned with a strategy known as "tax loss harvesting". The general idea is that there may be value in realizing a capital loss in some circumstances due to the potential tax benefits. Consider one hypothetical situation: An investor buys $10,000 worth of XYZ stock in February 2014 by mid November, the stock has fallen to a value of $9,000 The investor's income places them in a tax bracket where they pay 25% on marginal income. Selling the stock and "realizing" the $1,000 net loss may allow them to deduct that loss from their income, "saving" $250 on income tax [$1,000 loss * 0.25 tax rate = $250] Whether it makes sense to sell the investment or hold it for potential future gains depends on a number of considerations and should be discussed with relevant advisers (tax professionals and investment advisers). In the case where the "best choice" appears to be realizing the loss, that action must be complete within the calendar year to impact that year's taxes. Here are a few important considerations and potential obstacles to employing a tax loss harvesting strategy:

DRW Financial does not provide tax advice. The following is a general discussion of one strategy available in some circumstances. Please consult a tax professional prior to engaging in any action with taxable consequence.

12/16/2014 beneficiary reviewThe end of the calendar year is a good opportunity to review, adjust, and take some actions relevant to a financial plan or investment strategy. This blog post is one in a short series examining a few of those items. The information below is not intended as formal advice for any particular circumstance, but rather a general discussion of the topic. Many people have a number of assets that require them to name a "beneficiary" -- this would be the person, people, or institutions that stand to inherit the asset when the current owner dies. Trouble arises when folks choose the beneficiary and then forget to review that choice over time. The end of a calendar year is as good a time as any to take a minute and revisit these accounts and the designated beneficiary / beneficiaries. retirement accounts (ira, 401k, etc)In very general terms, "retirement" accounts allow a person to save money during their working years with the benefit of deferring income tax on the (potential) gains within those accounts until retirement age (typically 59.5 or older for most types of these accounts). When the account is opened, the owner is able to name one or many beneficiaries to inherit any remaining balance when the owner dies. These beneficiary designations can be made by percentage (25% to one heir, 75% to another, for example), and there are options on making the designations per stirpes or per capita (consult your tax / legal expert for more info on the difference) life insurance / annuitiesAs with retirement accounts, when a person purchases a life insurance policy, signs up for a workplace insurance program, or invests in an insurance product like an annuity, there is an option to name a beneficiary to receive the proceeds of the policy when the insured person dies. And similarly as with retirement accounts, too often people set up these beneficiary elections and then forget about them. checklistHere are a few things to consider when reviewing asset accounts and insurance policies with beneficiary elections:

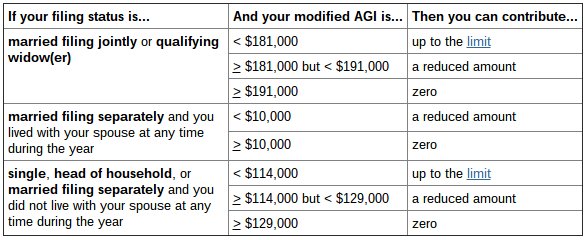

12/11/2014 ira contributionsThe end of the calendar year is a good opportunity to review, adjust, and take some actions relevant to a financial plan or investment strategy. This blog post is one in a short series examining a few of those items. The information below is not intended as formal advice for any particular circumstance, but rather a general discussion of the topic. Individual Retirement Accounts are a core piece of the investment management and financial planning process. The potential tax benefits for people holding their investments in a traditional or ROTH IRA (or the "rollover" versions of those same options) can be significant. This blog post seeks to capture some basic but important information relevant to IRA accounts. The information shown is taken from relevant IRS websites, and each section provides links to those pages. Please visit the source pages prior to making tax related decisions, and/or consult with a tax professional. deadline to contributeEligible contributions for 2014 may be made until April 15, 2015. While the deadline itself is several months into next year, it may be advantageous to consider your circumstances before year end in case there are related actions that must be taken within 2014 (tax loss harvesting, for example). contribution limitsThe amount you may contribute to a traditional or ROTH IRA changes over time. The limits for 2014 and 2015 are set at $5,500 ($6,500 if you are 50 years old or older). Specific to ROTH IRAs, contributions are additionally limited by your income and filing status, per the table below: deduction limitsROTH IRAs offer no income tax deduction in the year of contribution. Traditional IRAs may offer a deduction, depending on whether you (or your spouse) are covered by a retirement plan at work and whether your income falls within certain ranges as described in the table below:

12/9/2014 Market headwinds: energy A long enough career as an observer of the markets will teach many lessons; one lesson that comes up time and again is that cycles exist within the market (all markets). Sometimes the cycles make sense event to superficial examination, and sometimes they do not. The above chart shows the 12 month return on price for the Energy Select Sector SPDR ETF, an exchange traded fund that tracks a portfolio of companies in the energy business (Exxon, Chevron, Schlumberger, etc). It has been a tough 12 months. For contrast, the performance for ETFs tracking the S&P 500 and Dow Jones Industrial Average (SPY & DIA, respectively) was +13.12% and +10.45% as of this writing. Why are energy companies suffering? An answer in one chart:  Brent Crude Oil Spot Price data by YCharts The 12 month move in the price of oil is a bit dramatic. It should be apparent that, at least in the short term, the market for energy itself is having a depressing effect on companies that produce and deliver energy.  Brent Crude Oil Spot Price data by YCharts |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed