|

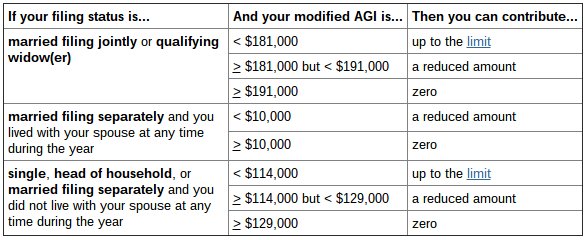

12/11/2014 ira contributionsThe end of the calendar year is a good opportunity to review, adjust, and take some actions relevant to a financial plan or investment strategy. This blog post is one in a short series examining a few of those items. The information below is not intended as formal advice for any particular circumstance, but rather a general discussion of the topic. Individual Retirement Accounts are a core piece of the investment management and financial planning process. The potential tax benefits for people holding their investments in a traditional or ROTH IRA (or the "rollover" versions of those same options) can be significant. This blog post seeks to capture some basic but important information relevant to IRA accounts. The information shown is taken from relevant IRS websites, and each section provides links to those pages. Please visit the source pages prior to making tax related decisions, and/or consult with a tax professional. deadline to contributeEligible contributions for 2014 may be made until April 15, 2015. While the deadline itself is several months into next year, it may be advantageous to consider your circumstances before year end in case there are related actions that must be taken within 2014 (tax loss harvesting, for example). contribution limitsThe amount you may contribute to a traditional or ROTH IRA changes over time. The limits for 2014 and 2015 are set at $5,500 ($6,500 if you are 50 years old or older). Specific to ROTH IRAs, contributions are additionally limited by your income and filing status, per the table below: deduction limitsROTH IRAs offer no income tax deduction in the year of contribution. Traditional IRAs may offer a deduction, depending on whether you (or your spouse) are covered by a retirement plan at work and whether your income falls within certain ranges as described in the table below:

Comments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed