|

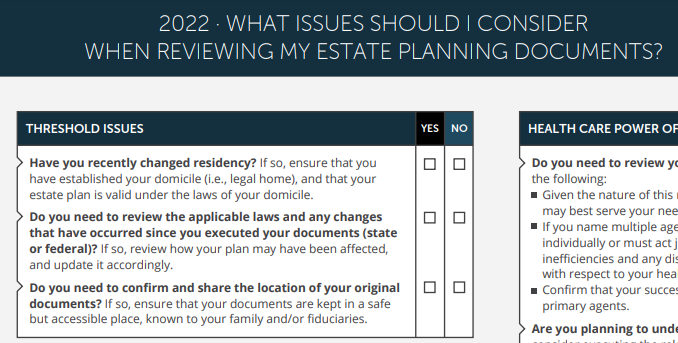

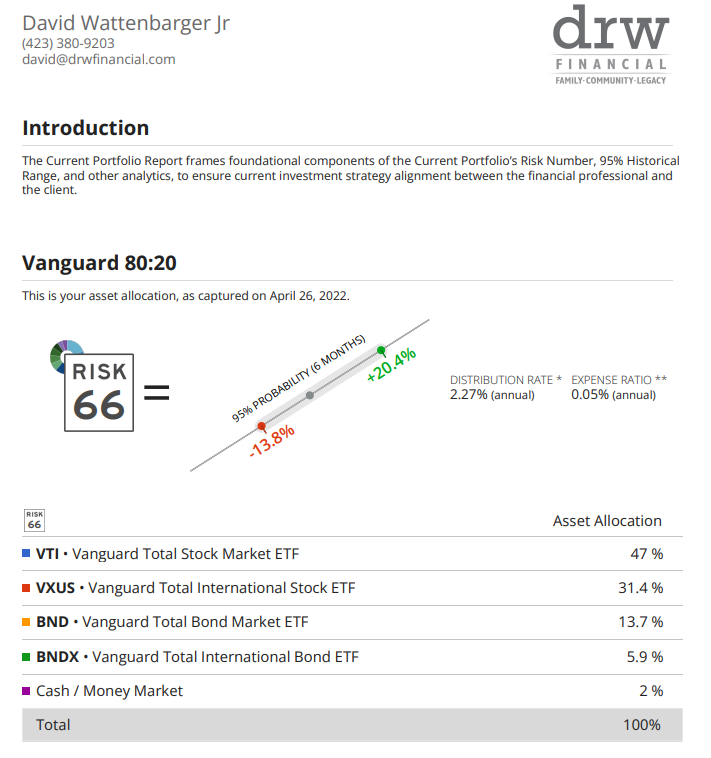

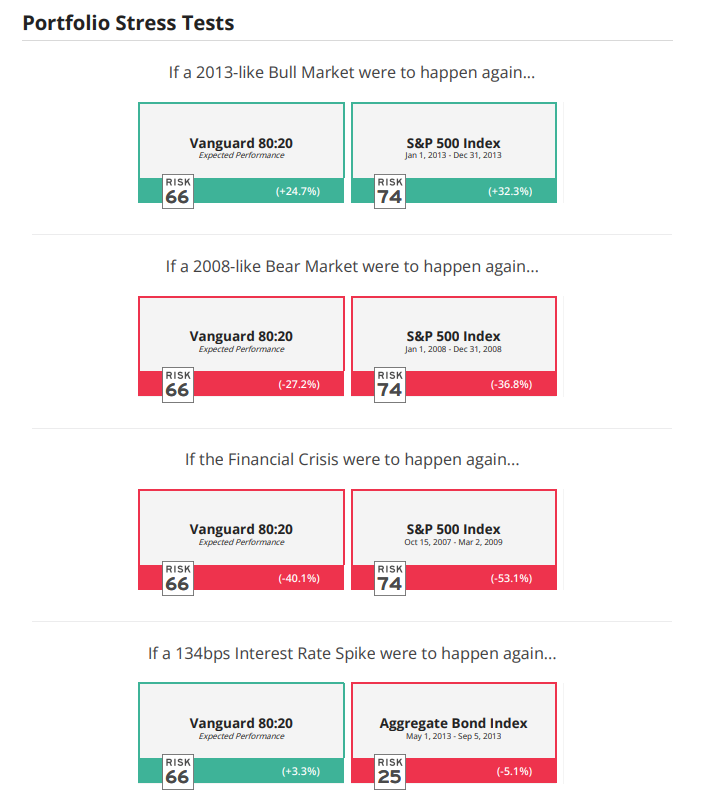

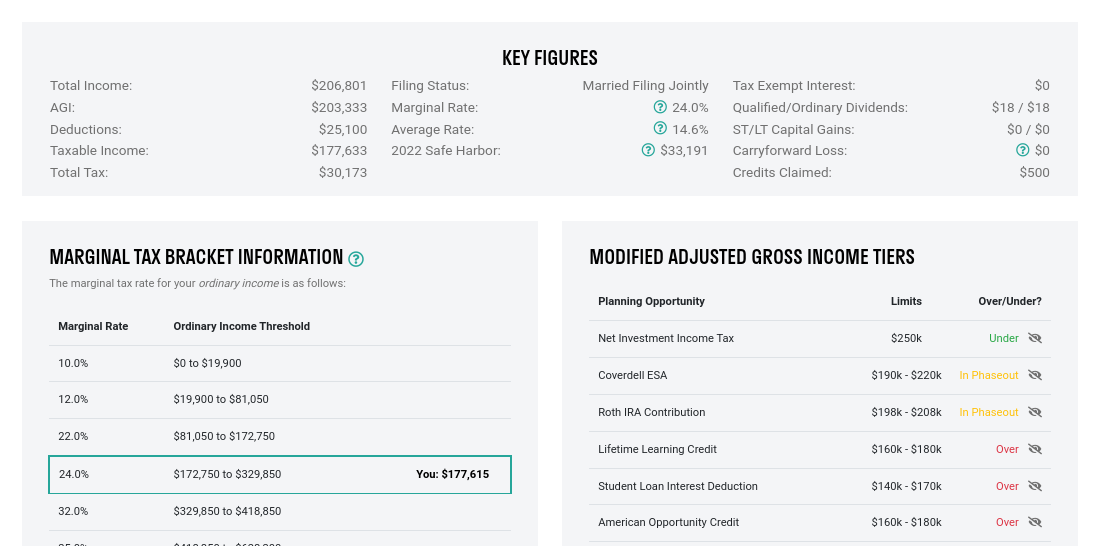

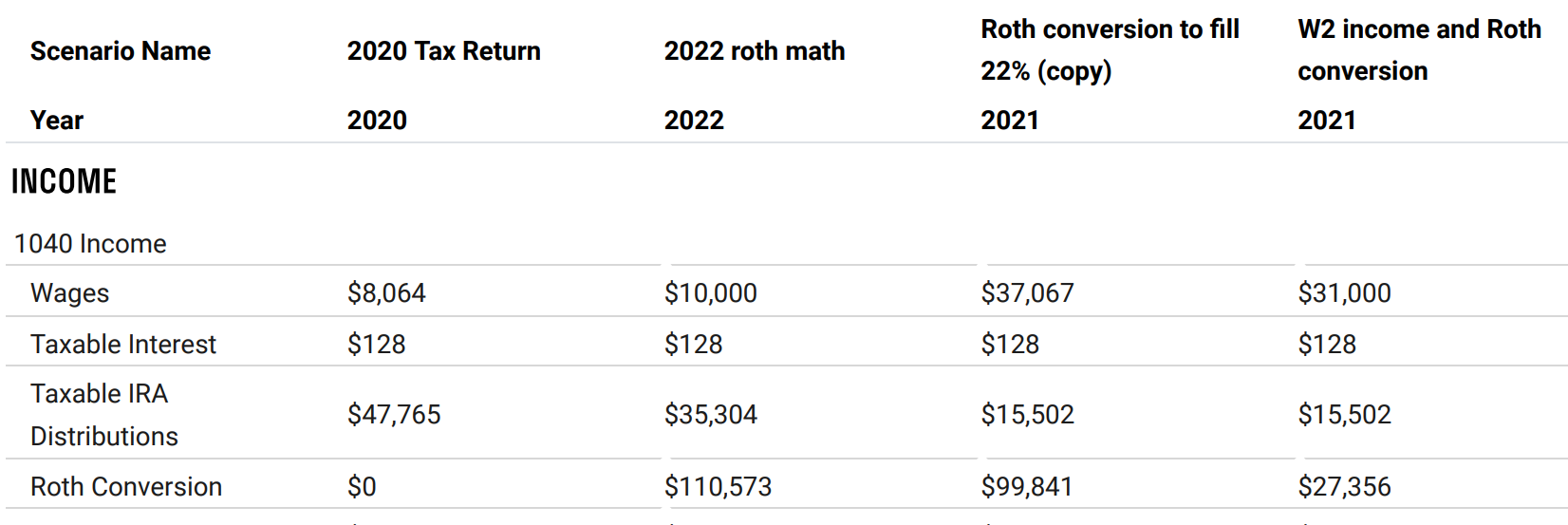

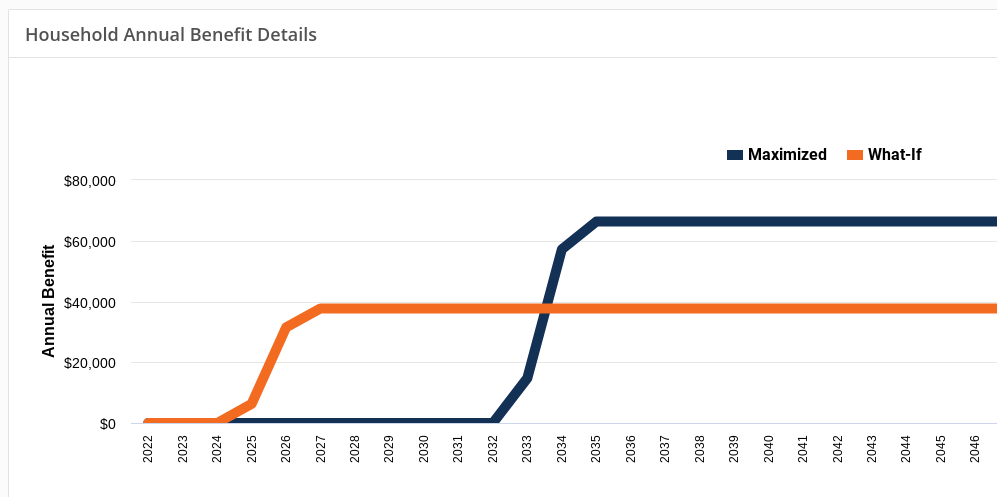

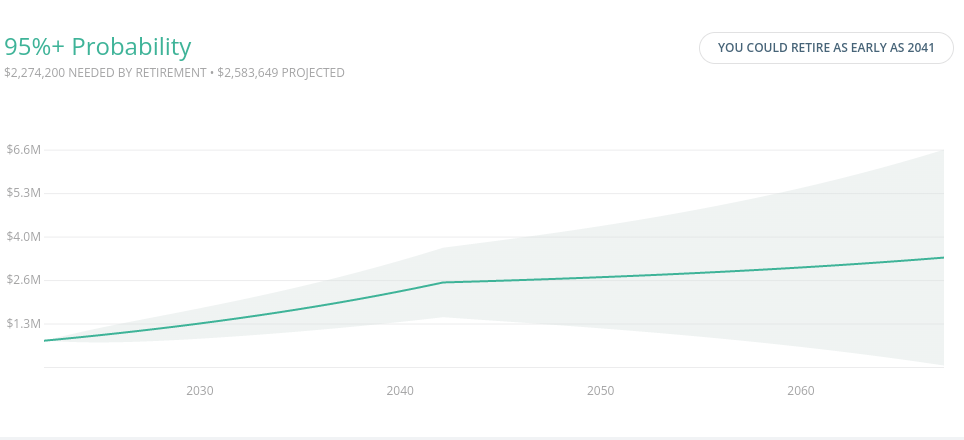

DRW Financial offers a full suite of financial planning and investment management services, and we want to make sure that our new and existing clients realize the full value of their engagement with us. This post is meant to provide an overview of the different types of service and work we do with clients, but is not exhaustive. Particular client situations often lead to unique planning projects; these items apply to a broad set of circumstances: Flow charts, check lists, and decision treesPersonal financial planning can quickly go from "rules of thumb" to incredible complexity based on a given household's actual situation. We have found great value in these resources that facilitate a conversation around a client's specific needs. We have resources around the decision framework for Roth vs traditional retirement, how to transition from employed health insurance to Medicare, and checklists for issues related to divorce, the death of a parent/spouse, etc. If you reach out to DRW Financial about a particular concern, we will gladly share these resources and help you navigate your situation. Portfolio ReviewThese are sample images from a platform we use to gain quick insights into the underlying structure, cost, and risk of a given portfolio. These reports often provide a starting point for deeper conversations about how to dial in an investment strategy for a particular client or goal. We can provide these reports on request for portfolios managed in-house as well as those held away, whether with another financial advisor, broker, or in a plan such as a 401k. Tax PlanningDRW Financial does not provide tax advice and does not prepare tax returns, but does provide guidance around the intersection of tax and financial planning. We use reports like the sample shown here to help clients gain clarity around their taxes, and better to understand where there may be planning opportunities. This type of analysis sometimes flows into scenario modeling for planning alternatives such as how a Roth conversion may impact taxes now or later. When clients (securely) provide us with copies of their returns, we can produce this type of analysis on demand. Retirement Income Planning and ProjectionsWe combine best-in-class resources to analyze the strategies and opportunities for optimizing the retirement phase spending plans, including social security (the first image above), and various investment options. The aim of this process is to help clients to a place of increased clarity and confidence around their retirement goal; sometimes this means uncovering challenges that need to be addressed, and sometimes it means recognizing an abundance that enables new opportunities. What rounds out a comprehensive plan?DRW Financial clients can "opt in" to planning and investment management engagements that address all of the above, as well as other planning areas:

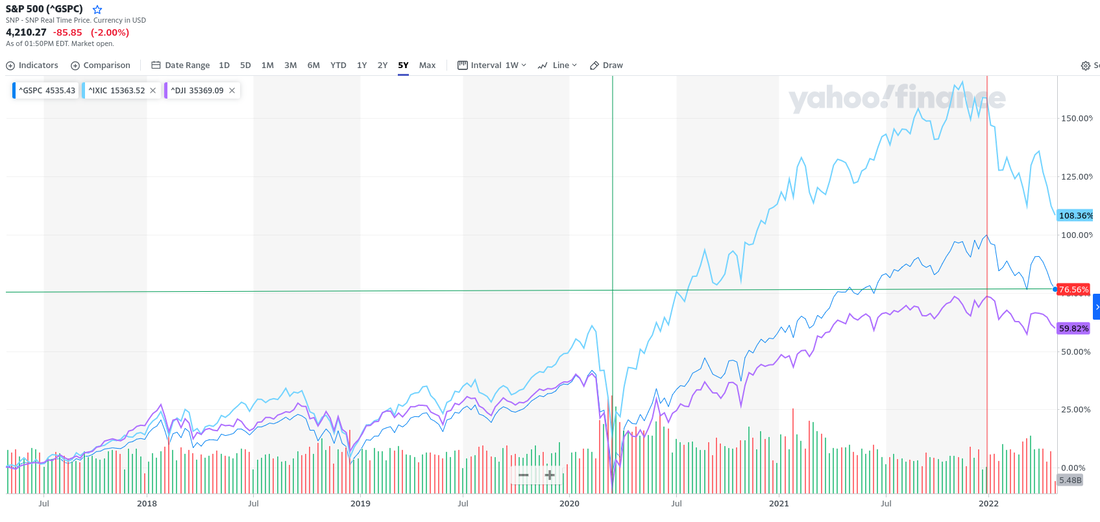

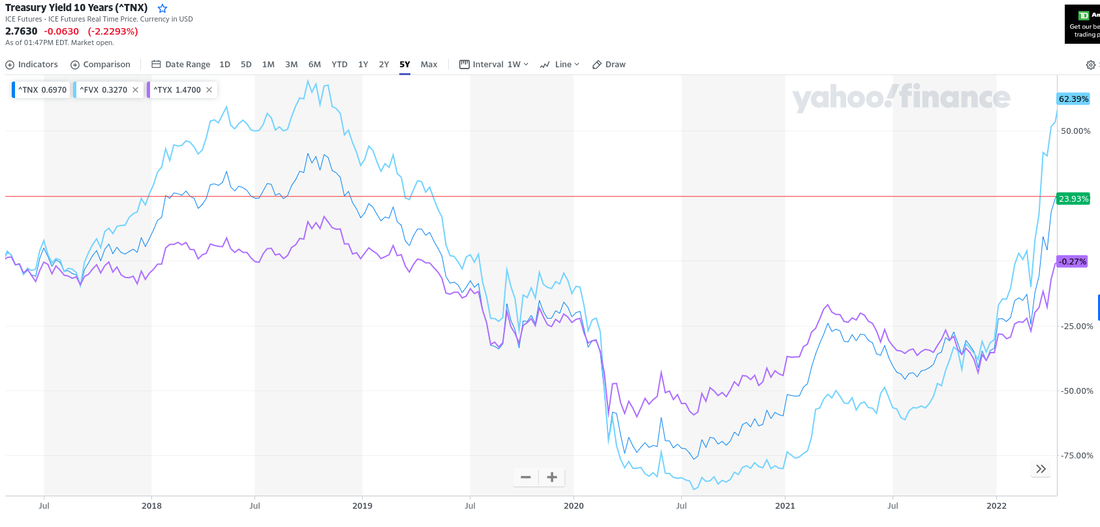

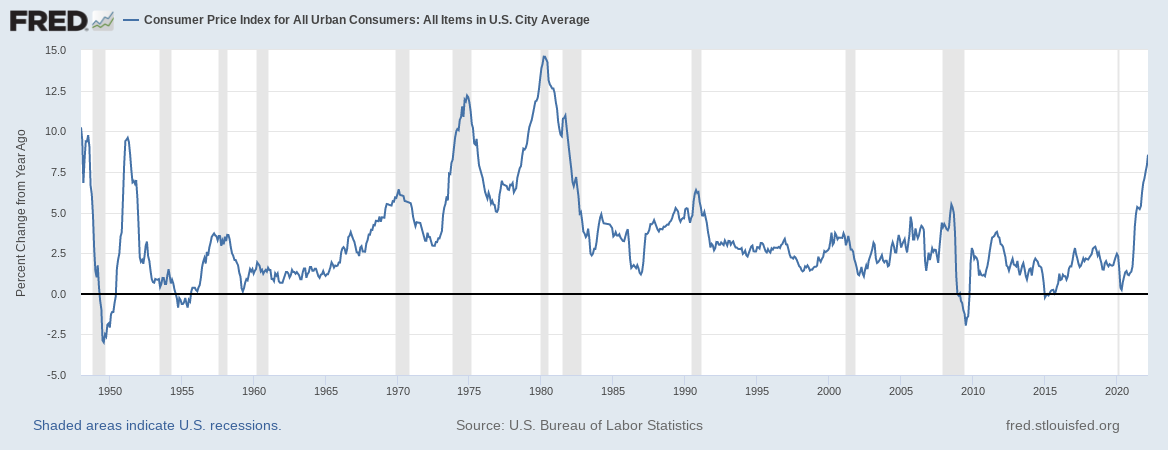

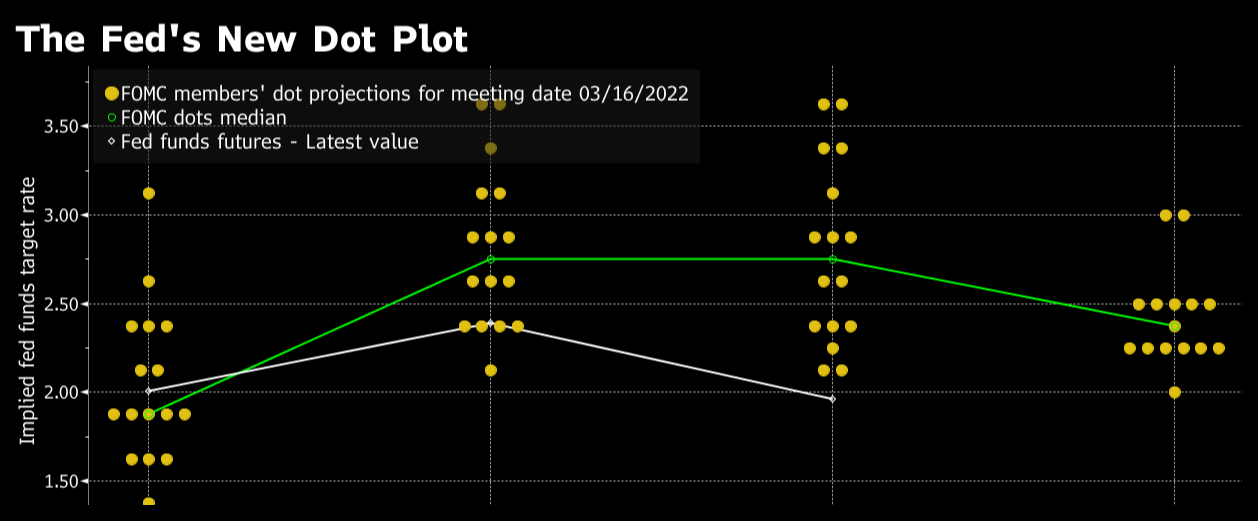

And if you are prospective client, you may schedule a free initial consultation via www.DRWFinancial.com 4/26/2022 Market commentaryThe last few days, and in fact this whole year so far, has presented some volatility and periods of market decline that may come as a surprise to those who have gotten accustomed to prices only "going up". This post seeks to put the current market in a broader context and share some of my thinking about what may be ahead of us. This chart shows the last 5 years of market movement for the S&P 500, Dow Jones, and NASDAQ indexes. The green vertical line shows the approximate worst levels of the early COVID related market crash, and the red vertical line shows the highest level on the S&P. As of this writing, the S&P is down about 12% from that high. The 5 year picture, and the YTD picture taken together provide some interesting context. Our experience is that the market can be volatile, with significant swings in price, and looking at too narrow a slice of time can be very misleading. It is a bit wild to see how much the markets grew during the COVID pandemic. This second chart shows the path of interest rates over the last 5 years, specifically the rates for the five, ten, and thirty year US treasury bonds. The horizontal red line shows the current level of the ten year treasury. Many parts of our economy price off of the treasury market; corporate and municipal bonds, for instance, will generally yield some amount over the treasuries of similar term. Mortgage rates also tend to follow the treasury market, particularly the ten year yield. So a chart showing rates in the rest of the bond and mortgage markets would generally have the same shape. Bond prices move inversely to their yields, so this year-to-date has been very rough on bond prices and funds...at the same time that stocks have sold off. Historically the relationship between stocks and bonds has varied, but in the era of Fed and US government "stimulus" programs to ward off the worst outcomes during the "great recession" and now the COVID era, stocks and bonds have been trading together more often. So what is coming next? These two charts are related -- the first is a graph of the main measure of US inflation, and the most recent spike has been in the news headlines and on our grocery store receipts. The second chart (from the Bloomberg article linked below) is the so-called "dot plot" projecting the Federal Reserve's likely path for their interest rate targets. When the Fed raises rates, the short end of the treasury market will follow suit...or, in our current case, the treasury market will move in anticipation of the Fed. The current dot plot suggests that the Fed may eventually raise rates into the ~ 2.5% range. If inflation readings keep coming in hot, the Fed will likely adjust their target even higher. 2.5% is high relative to the recent levels near 0% that were put in place to stimulate / protect the economy, but is not high relative to the long term average. Taken all together, this data paints a picture that to me suggests a few things:

My investment management approach will likely continue to follow the pattern: an asset allocation model that includes stocks and bonds and cash in proportion to the individual client's capacity for risk and investment goals. This approach has historically offset some amount of volatility and maintained the potential for economic returns over time. I am available to discuss the particular advice and investment allocation for a given client on request. Historical returns do not guarantee future returns. This post is not intended as advice or a solicitation of any kind. Dot Plot article: https://www.bloomberg.com/news/articles/2022-03-16/the-fed-s-new-dot-plot-after-its-march-policy-meeting-chart

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed