|

10/6/2016 is it bad to die with $0 left?I think it is pretty common for people to fear "running out" of money. We've all heard stories of people "dying broke" or reduced to poverty late in life, and those stories are both sad and scary. So it makes a great deal of sense to avoid that fate. Financial planning and prudent investment management play a crucial role in an overall approach to help ensure there are sufficient assets and income in place as we age, and they can also help prevent having too much left over as well! how can there be too much money?If we all agree to the premise that it is generally not comfortable to run out of money during our lifetimes, it may then seem counter-intuitive to discuss the opposite challenge of dying with too much income or assets. But prudent personal financial management also involves making a plan for the eventual distribution or transfer of an estate, as well as the care of the people and causes that have mattered to the person during their life. A well crafted financial plan will seek to find an appropriate balance between having too little and having too much. quick look at "too much"What happens when you die with "too much" in terms of assets?

what's the plan?The points above are meant to highlight that, while having assets and income is probably a better state of affairs for most people than having none, it is also the case that having significant assets and income involved demands careful planning as well. A robust financial plan with a qualified financial planner, such as a CFP®, should seek to address both ends of this question, from dying with too little to dying with too much, as well as a number of other important financial considerations. Ready for more information?Click the "let's talk" button to send me an email. I am a fee-only, registered investment advisor offering highly transparent financial planning and investment management advice in a fiduciary context.

10/4/2016 exploring the emergency fund

It's not always easy to get a bead on exactly what "normal people" understand about their finances. I tend to frequent public blogs and forums (places like Reddit and Quora) where people discuss personal finance best practices and strategies, as well as industry "insider" newsletters and trainings about investor psychology and behaviors. My top level impression is that most people have a pretty decent, general idea of "personal finance": save some money, invest for the long term, try not to overpay for advice.

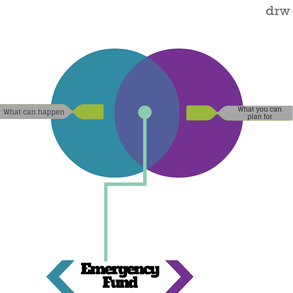

One very basic part of every financial plan, and one that tends to be reduced to a simplistic rule, is the "emergency fund". It could also be called "cash on hand" or "liquid funds" or something similar, but the idea is the same: this is a stash of money set aside from the monthly budget (it shouldn't be spent down and replenished in a "normal" period) and that it mostly held in a very low risk way (checking or savings account at the bank is very typical); the purpose of this money is to cover extraordinary expenses or demands on the budget to prevent serious disruptions to regular bills, lifestyle, and use of credit. It is impossible to know the future with certainty and to plan for ever possible eventuality, but it is possible to plan for a series of reasonably likely demands on the household budget (as suggested in the picture above). So that explains in general terms what the emergency fund is, but leads to the more practical questions around where does this rank among goals, how much is necessary , and how to hold the funds.

the emergency fund is a priority

Every person and every household have different specific needs and challenges, but everyone engaged in the process of financial planning is going to share in some measure this goal of having cash set aside for budget shocks, and that goal is going to be very near the top of their list of priorities (or should be). "Cash flow" may not sound sexy, but once the flow of cash through a budget is pinched, everything else financial becomes very difficult to manage. For that reason, in my planning and investment advisory work with clients, we focus on addressing this goal early and revisiting it often as life changes impact the answer to the how much question. And speaking of...

the "rule of thumb" is a starting place - Not an end to the conversation

If you were to Google "emergency fund amount" or "how much do I need in savings for emergencies" you will likely find a number of sources pointing to a rule of thumb suggesting "three to six months of expenses". And that is totally a reasonable place to start the conversation, provided that person's budget is pretty stable to begin with and they earn more than they spend on a regular basis. But this is only a starting place for the conversation, because the details in peoples' lives vary so much. Here are some considerations that could move a given person's emergency fund needs up or down significantly:

consider a tiered approach to risk

Having money in an emergency fund but not being able to access it in an emergency renders the whole exercise pointless. With this in mind, it makes sense to consider liquidity and risk for how those funds are held. Some people may wish to consider a "tiered" approach to holding or investing their emergency fund, particularly people with a relatively high dollar amount allocated for this purpose.

review, revise, pivot

To wrap this up with one more piece of practical insight: The amount set aside of emergencies should be informed by each person / household's actual circumstances and exposures, and these should be reviewed periodically for fit. When things change, the emergency provisions should also change. In some cases, the "emergency" turns out to be the new status quo and things must be adjusted more dramatically for the long term; for example, a "short term" unemployment may turn out to be more permanent, and the emergency fund alone will not defend the existing budget and financial goals. Or on a more positive note, people who find themselves with total wealth and income far outstripping their potential needs may choose to stage themselves out of holding a reserve account.

Ready to do some planning?

If conversations like this one pique your interest and you are ready to dive deeper into planning your own finances, email me at [email protected]. I am registered as an investment adviser in the states of Tennessee and Georgia, and may provide advice to residents of 46 other states under certain circumstances (no TX or LA at this time). Or for a quick review of your current situation, feel free to click the following buttons:

Quick and free risk analysisSimple retirement goal check-up |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed