|

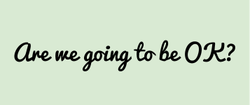

5/15/2014 Anatomy of a trade: a discussion I often talk about the personal side of what I do: the holistic conversations about a client's life, their goals, their values, their feelings. These topics come up often because they are what matter the most, both to the client and to me. There is a reason I designed DRW Financial to focus on Family | Community | Legacy -- money is a tool useful for supporting our values; our values should not be bent to serve our money.  Not just a pretty logo, but a mission statement in 3 words. And yet, the second role we play at DRW Financial is as "investment manager". This is where the art+science of a robust financial plan gets realized in numbers, and real money gets put to work in real investments. So I wanted to take a minute today to share a small piece of the philosophies underlying our approach to investment management. If you are curious about a bit of the "technical" work we do, read on. In the broad scheme of things, DRW Financial would be considered to be in the "active management" camp, meaning we continually monitor investments within our portfolios, as well as the rest of the market seeking to carve out opportunities to realize value. Active management in our case also tends to lean toward the use of individual stocks and bonds, some ETFs (exchange traded funds), the occasional option, and generally leans away from traditional mutual funds. A new position for the firm generally starts with a search in our stock screening software, with a certain set of parameters (there's a sample screen in the image above). Within a given set of screener results, we work to narrow down the choices to a few that stand out as "most attractive", and then spend some time to clear away the noise around those stocks and try to really see through to the underlying values. We only buy a given stock when there is a rationale we can articulate clearly, and that rationale will almost always be built around the stock being "cheap" on a valuation basis. WHAT FOLLOWS IS A DISCUSSION OF AN INDIVIDUAL STOCK AND AN ACTUAL TRADE SITUATION. THIS BLOG IN GENERAL AND THIS POST IN PARTICULAR ARE NOT MEANT AS INVESTMENT ADVICE FOR ANY PERSON, AND IS NOT A RECOMMENDATION TO BUY OR SELL A SECURITY. Following the basic process outlined above, in November of 2013 we identified what we thought was a disconnect between the value of Cisco Systems (CSCO) stock as priced in the market and the "underlying value". So at that time and in a number of client accounts, we bought shares on November 15 at an average price of 21.38. In the very short term, it looked like we may have made an error in judgement -- CSCO dropped lower in price while the broader S&P 500 index went sideways. And in an ideal circumstance we would have bought at the lowest price in late December. As it did turn out, we held the stock 6 months to the day, collected two dividend payments in January and April, and sold this morning at an average price of 24.27. Why did we sell today? Is it possible that the stock price could continue to climb? It is possible (maybe even likely) that CSCO will post some higher prices in the near future, but as mentioned above, we run these value evaluations constantly and in late April the data suggested that 24 would be a "full valuation" for the stock. At that time we entered a "sell limit" on CSCO at 24 -- we use this type of order to watch the market for us automatically and sell (or buy) a stock if & when the market moves quickly and we may not be available to place a trade. And so it happened that CSCO announced their earnings last night and the market reacted enthusiastically this morning, pushing the stock up significantly (the jump is more evident in the 5 day chart below). This was a good trade for us, and I'm happy with the way it worked out. None of this suggests that every trade we make has or will work out the same - many trades lose money or take a long time to "play out". We are also not trying to suggest that ours is the only or best way to make investments; on the contrary, we believe that the market is made up of a great mixture of great and terrible ideas, blind luck, and horrible timing all jumbled together. But it is our aim to collect together a small group of clients who appreciate our approach to investment management...or they can be ambivalent to our investment approach but really value our approach to planning for the financial care and security of their Family | Community| Legacy. DISCLAIMERS ROUND 2: WE MAKE NO REPRESENTATIONS ABOUT RETURN, PAST - PRESENT - OR FUTURE. ALL DATA SHARED ABOVE IS BELIEVED TO BE ACCURATE AND IS INTENDED SOLELY AS A FACTUAL DISCUSSION AND FOR EDUCATIONAL PURPOSES.

5/1/2014 Mayday! Mayday! How are you feeling? Like the long, cold winter is over? Like summer is right around the corner? Like school is going to be out any day now? What about your financial life? With 4 months of the year passed, do you feel like 2014 is coming to reflect your vision and values, or are you starting to feel like another year is slipping by with little to no progress on realizing your goals? As far as the market goes, the year is off to a reasonably positive start. As shown in the chart above, the S&P 500 stock index is up about 1.8% so far this year, and the 10 year treasury interest rate has actually fallen (meaning bond prices have risen) -- this outcome may come as a surprise to many who believed rising rates were a foregone conclusion. But these are just impersonal numbers -- your situation and feelings about your own financial well being are going to depend more heavily on issues particular to you: do you feel more comfortable, more secure, more prepared than you did in January, or in May of last year? Too often in conversations around investment planning and money management, the focus falls squarely on performance and percentages, when really what most of us want to is to believe that we're going to "be ok".  It's a good question. But maybe some better questions are:

Happy May Day, everyone. Here's to a brilliant spring season.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed