|

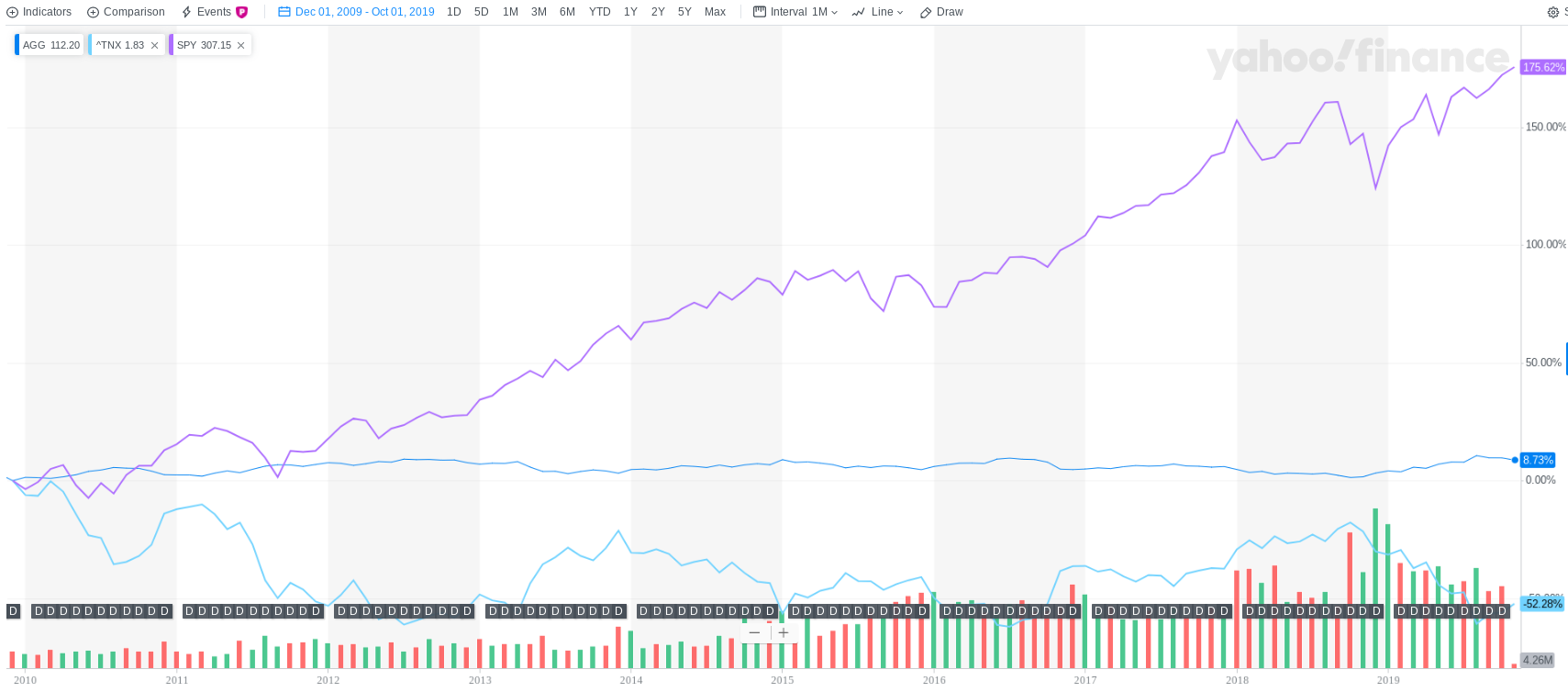

11/5/2019 Guessing about the market's futureIt is apparently the season when the big investment banks announce their assumptions for how the market may perform over both the next year and the next decade. Both Morgan Stanley and JP Morgan have recently released their forecasts, and I want to take the opportunity to share my views and how DRW Financial intends to work with our clients’ investment needs both now and later. We know that it is a fraught exercise to try to predict the future with any certainty, no less so when discussing financial markets. With that in mind, I read posts like these from JP Morgan and Morgan Stanley as “informed guesses”, and try to recognize that those firms need some baseline estimates in place to inform the work they do. We also need baseline estimates to help us build portfolios that have a chance of matching up with our clients, their needs, and their goals. Both JPM and MS are offering fairly constrained guidance for the next 10 years or so, and both focus their explanations on a typical “60:40” portfolio, meaning an asset allocation with 60% of the funds holding stocks and 40% holding bonds. Morgan Stanley’s guess is that this type of portfolio would return approximately 4.1% on average, annually, and JP Morgan puts their number a bit higher at 5.4%. It is worth noting that both numbers are significantly lower than the average over the last 10 years (roughly 10% per year average return on an inflation adjusted basis) or 20 years (roughly 7.2% on an inflation adjusted basis). The context and “why” of these forecasts may be useful, as well. We find ourselves in a situation where stocks AND bonds have performed pretty well over the last 10 and 20 year timeframes. Since November of 2009, stocks (as represented by the S&P 500 index) have risen about 175% in total, bonds (as measured by the AGG “aggregate bond fund”) have risen about 8% total on price, in addition to their income distributions, and interest rates (as measured by the 10 year treasury yield) have fallen by about 52% — when interest rates fall, bond prices rise. Part of what goes into these market forecasts is a guess about whether trends can continue or not — while there is not technically a cap or ceiling on stocks and their ability to continue to rise, history has shown us that “corrections” occur with regularity (a “correction” is defined as a 10% or greater decline in stock prices); with bonds, there is a more natural cap or ceiling on price increases, as yields approach ~ 0%. So what do we think here at DRW Financial, and how are we preparing for the next market cycle? We start with a dose of humility, and recognize that we cannot know precisely what the market will bring. We follow evidence based best practice in advising clients, not only on their investment choices, but also about their broader approach to financial security. We choose an asset allocation mix that suits each client’s tolerance for risk, and that matches their specific goals. We fill that asset allocation with low cost and well managed index funds, and we rebalance and evolve both the allocation mix and fund choices over time as the client’s situation changes and better fund options become available. To optimize for whatever the market brings, we pay attention to the way our asset allocation choices interact with each other (specifically via correlation, or the way two assets tend to move together or not). We prefer to avoid high correlations within our portfolios so that a shock in one part of the market does not pull the whole portfolio down. We seek to diversify not only by asset class (stocks, bonds, real estate, etc), but by geography and underlying currency and place within the market (think “small cap” vs “large cap” stocks, or “developed” vs “emerging” international economies). And then...we wait and see. If the market does great, we adjust. If the market does poorly, we adjust. If an opportunity arises to take some measure of risk “off the table” and still meet the client’s goal, we do so. So whether the market rises by 5% or 10% next year, or falls by 20% or more, we have a plan in place designed to match the needs of our clients, and informed by the experience and best research we can find. Resources and references:

A CNBC story about Morgan Stanley's forecasts JP Morgan release on November 4, 2019 titled "Long-Term Capital Market Assumptions Executive Summary" 10 and 20 year "60:40" data generated at PortfolioVisualizer.com |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed