|

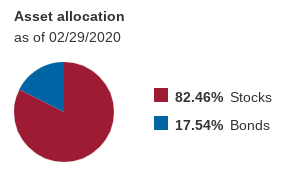

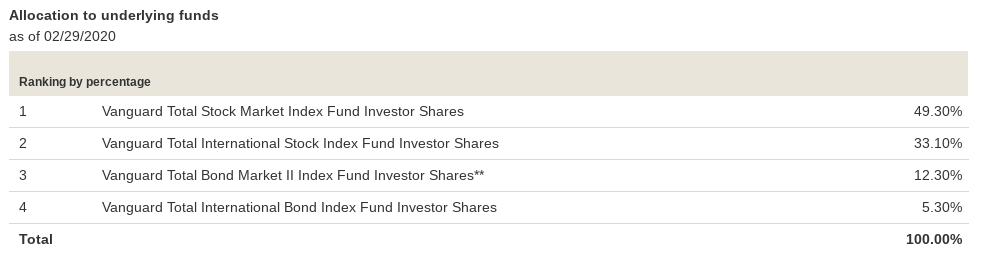

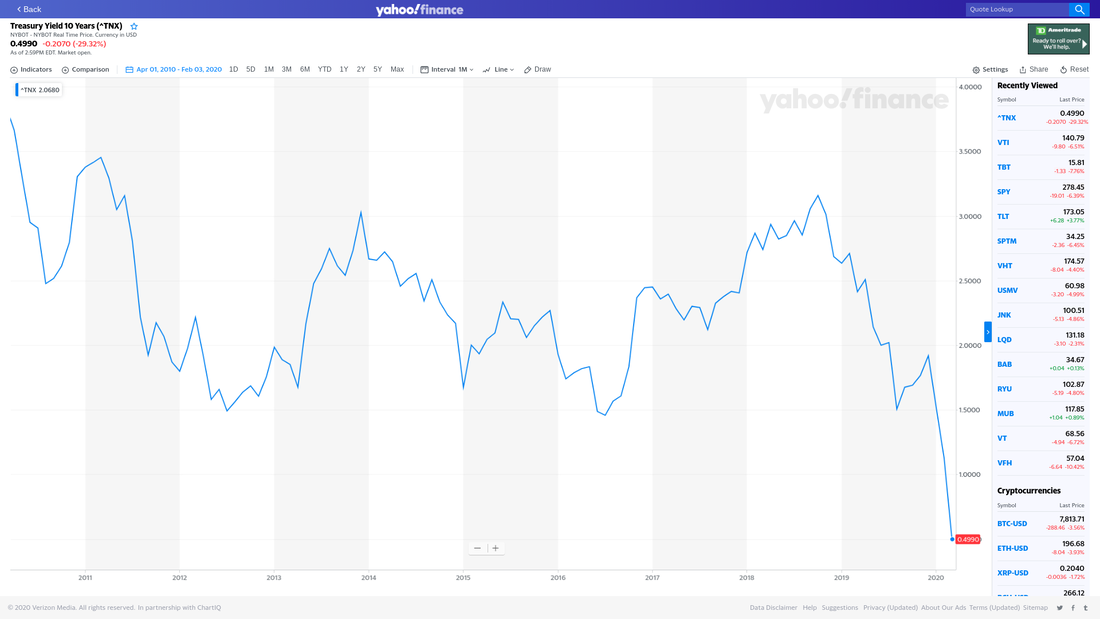

This post focused on target date funds, but could similarly apply to a "passive" portfolio of index funds that includes an allocation to bonds. Target retirement date mutual funds have become a mainstay of employer sponsored retirement plans (401k plans, for example), and many retail investors are choosing these options as well for their simplicity. The general idea of a target date fund (TDF) is that the fund holds a mix of assets - -mostly stocks and bonds -- in proportions that shift over time to lower the portfolio's expected volatility into the retirement date. In overly simplistic terms, this means that a far off target date fund will hold mostly stocks, and a very close target date fund will hold a relatively high proportion of bonds. For one example, consider the Vanguard Target Retirement 2040 fund, symbol VFORX: This fund is meant for investors who believe that the year 2040 is likely when they will begin taking retirement distributions from their savings, or at least represent the amount of risk they want to take with those savings in the present. The Vanguard page for this fund also shows the underlying funds that make up the TDF: For this blog post, I want to focus on the bond allocations within this fund. We can get more information on each, as they trade independently of the TDF under the symbols VTBIX and VTIBX. For further simplicity here, I will focus solely on the domestic fund, VTBIX. The rationale for holding bonds in a "diversified" portfolio along with stocks is that they historically represent different types of risk, and they typically respond differently to major shifts in the market's perception of risk. Often, in times of distress for the stock market, some investors will shift some of their money from stocks to bonds in pursuit of more stability or predictability, and this shift may raise the prices of bonds temporarily. And this general dynamic played out in the recent stock market correction related to the COVID 19 virus -- stocks fell, and at first bonds of almost every type rose. A subsequent wave of market reactions pushed US Treasury bonds higher still, but bonds of almost every other type (corporate bonds, municipal bonds, mortgage backed bonds, etc) fell a considerable amount as the market adjusted to consider the risk of those bond issuers "defaulting" on their obligations. For example, investors were forced to consider if bonds backed by a particular retailer or airline or car company would pay as expected if those companies were forced to close or go into bankruptcy. The chart below is clipped from CNBC, and shows the "year to date" price of the bond fund. That peak in early March, the sell off over the next two weeks, and the rebound up to today all match the general pattern of bonds in the market (except for US Treasuries which saw a much more muted sell off in mid-March) This all leads to the inspiration for today's post: what does it mean to continue to hold bonds in the current market? Will bonds continue to provide the volatility dampening effect as per historical precedent? Pulling together fact sheets, prospectuses, and other resources on this particular Vanguard fund suggests that the current composition of underlying bonds is roughly 44% US Treasuries, with another 22% in mortgage backed bonds from "government sponsored entities" like Fannie Mae and Freddie Mac. In the current environment, the Federal Reserve is actively buying up those two categories of bonds to provide support and liquidity to the market -- this means, that all else held equal, the prices of those categories of bonds are being pushed higher and their yields pushed lower. For the VTBIX fund, the SEC Yield is currently just under 2%, and the distribution yield just over 2.5% -- but the underlying "yield to maturity" of the bonds held by the fund is ~ 1.70%, an average duration of more than 6 years, and an average maturity of more than 8 years. Taken all together, an investor holding this fund (or one very similar) may want to consider the possible paths for forward for economic gain in the fund, or the ways this holding may contribute to the overall performance of their portfolio. The "total return" of a bond or bond fund is made up of cash flows and price movement. As in the chart shown above, an investor buying the VTBIX fund on March 17 or so would have experienced a rise in price in addition to whatever dividends and interest the fund paid out during the holding period. And an investor holding that fund from March 7 to March 20 would have seen a meaningful shift to a lower price. A question I am asking myself and on behalf of my clients in this market is what may I rationally expect for bond and bond fund prices looking forward? The author holds no positions in the referenced funds, and is not soliciting a buy or sell of any security.

We ARE reviewing client investments in the current context of compressed interest rates and prospective returns on bonds and fixed income allocations. 3/9/2020 You should revisit yield to maturityThe recent collapse in US bond yields to all-time historic lows presents an opportunity and an obligation to review the prevailing yield to maturity (and yield to "worst") of the bond and "fixed income" portions of an investment portfolio. We know that bond prices and yields are inversely related, at least for bonds with fixed coupons and no call features. As yields rise, prices fall; as yields fall, prices rise, all else held equal. In asset allocation theory, an investor may hold bonds as a sort of counter-weight to stocks -- while stock and bond prices may move together and in the same direction at times, when volatility in the market rises and stock prices fall due to perceived risk, bond prices tend to rise as investors seek more stability in more predictable investments. That dynamic has played out in the US investment markets over the last few weeks as the major stock indices have fallen by double digit percentages. Holding to Maturity, or notThe value of an individual bond is set by its yield. That is, the market sets a yield for the risk associated with that bond, and the price is calculated from that yield. A bond can have several different yield measures: yield to call, yield to maturity, yield to worst...From the perspective of the investor holding a bond, the "yield to worst" may best capture their economic opportunity. Bond funds do not behave exactly like individual bonds, but the value of a bond fund should relate to the underlying value of the bonds it holds. An investor who buys a bond or bond fund and then sees the relevant market yield for that investment fall should see the price of their investment rise, and so is presented with an opportunity to continue holding the investment or selling it at a gain. The decision between those options will require some analysis and will depend on the investor's particular circumstances. Original YTM and prevailing YTM aren't the sameWhen an investor buys a bond or bond fund, the yield to maturity on that day and at the price they pay does matter -- it establishes a basis and informs the expected holding period return if the bond is held to maturity. But as the price of the investment changes and the term to maturity decreases, the prevailing or mark-to-market yield to maturity (and yield to worst) also matter a great deal, but are often overlooked by investors and their advisers. Consider an example where a client buys a bond of SAMPLE COMPANY to yield 4% for 10 years, and in a few months finds that the market has set a new, lower yield for that bond at 2.5%...this would mean that the price of the bond would have risen to set the market yield for the bond at ~ 2.5% -- the investor could sell the bond at a capital gain to other investors who want the 2.5% yield. Why would a person sell in this situation? If their original goal was to earn 4% returns on their money, they may not be content to "only" earn 2.5%, but that is the remaining opportunity for that investor over the term of the bond. What's special about the current market |

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed