|

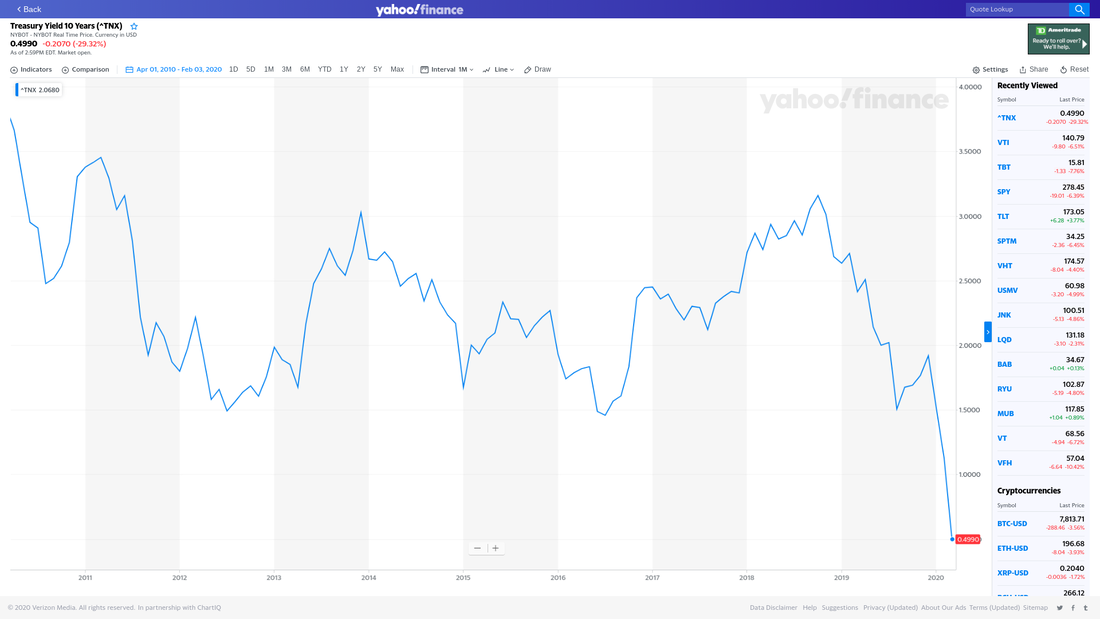

3/9/2020 You should revisit yield to maturityThe recent collapse in US bond yields to all-time historic lows presents an opportunity and an obligation to review the prevailing yield to maturity (and yield to "worst") of the bond and "fixed income" portions of an investment portfolio. We know that bond prices and yields are inversely related, at least for bonds with fixed coupons and no call features. As yields rise, prices fall; as yields fall, prices rise, all else held equal. In asset allocation theory, an investor may hold bonds as a sort of counter-weight to stocks -- while stock and bond prices may move together and in the same direction at times, when volatility in the market rises and stock prices fall due to perceived risk, bond prices tend to rise as investors seek more stability in more predictable investments. That dynamic has played out in the US investment markets over the last few weeks as the major stock indices have fallen by double digit percentages. Holding to Maturity, or notThe value of an individual bond is set by its yield. That is, the market sets a yield for the risk associated with that bond, and the price is calculated from that yield. A bond can have several different yield measures: yield to call, yield to maturity, yield to worst...From the perspective of the investor holding a bond, the "yield to worst" may best capture their economic opportunity. Bond funds do not behave exactly like individual bonds, but the value of a bond fund should relate to the underlying value of the bonds it holds. An investor who buys a bond or bond fund and then sees the relevant market yield for that investment fall should see the price of their investment rise, and so is presented with an opportunity to continue holding the investment or selling it at a gain. The decision between those options will require some analysis and will depend on the investor's particular circumstances. Original YTM and prevailing YTM aren't the sameWhen an investor buys a bond or bond fund, the yield to maturity on that day and at the price they pay does matter -- it establishes a basis and informs the expected holding period return if the bond is held to maturity. But as the price of the investment changes and the term to maturity decreases, the prevailing or mark-to-market yield to maturity (and yield to worst) also matter a great deal, but are often overlooked by investors and their advisers. Consider an example where a client buys a bond of SAMPLE COMPANY to yield 4% for 10 years, and in a few months finds that the market has set a new, lower yield for that bond at 2.5%...this would mean that the price of the bond would have risen to set the market yield for the bond at ~ 2.5% -- the investor could sell the bond at a capital gain to other investors who want the 2.5% yield. Why would a person sell in this situation? If their original goal was to earn 4% returns on their money, they may not be content to "only" earn 2.5%, but that is the remaining opportunity for that investor over the term of the bond. What's special about the current marketComments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed