|

12/18/2014 scenario analysis and planning"Financial planning" can easily describe a wide number of activities, some formal and some less so. In the course of onboarding a new client relationship at DRW Financial, we do a significant amount of data gathering and discussion around each client household's current financial condition and their assorted goals. This work builds a foundation that allows to make investment decisions, as well as to shape intentions impacting financial lifestyle, thoughts on the How & When of retirement, etc. We also do ad hoc scenario analysis to help frame a conversation around choice:

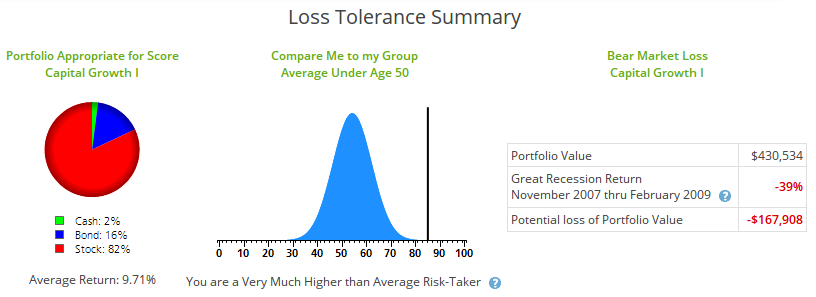

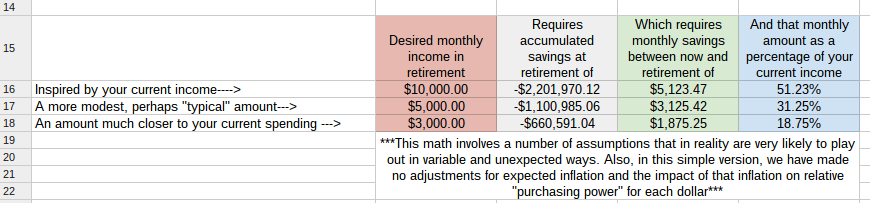

To facilitate this sort of discussion, DRW Financial applies a robust approach: We give sufficient time to discuss the ideas, and we take care to hear the questions. We work to communicate our informed experience of best practice and to outline what we see as the array of available "best options". And then we employ technology to capture those scenarios in a way that makes the relative costs, benefits, and risks apparent and available to inform the decision making process (as well as the subsequent review). One tool we use is Money Guide Pro; this platform does a pretty thorough job of calling out the typical goals and components of a traditional financial plan (sample screen shot below from the risk tolerance portion of a plan). Another tool we employ regularly are "old fashioned" spreadsheets (albeit cloud based and shared for real-time collaboration). Working through goals and scenarios in this manner can lead to a better shared understanding of the details involved in a particular approach or scenario, as well as providing a space to make all underlying assumptions very clear. The image below is from one such planning "workbook": DRW Financial's goal in each case is to truly serve each client in a fiduciary capacity, to assist them in uncovering their real values driven goals, to help them identify both the obstacles and the opportunities along the way, and to collaborate with them in creating an investment strategy best suited to those circumstances. Comments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed