|

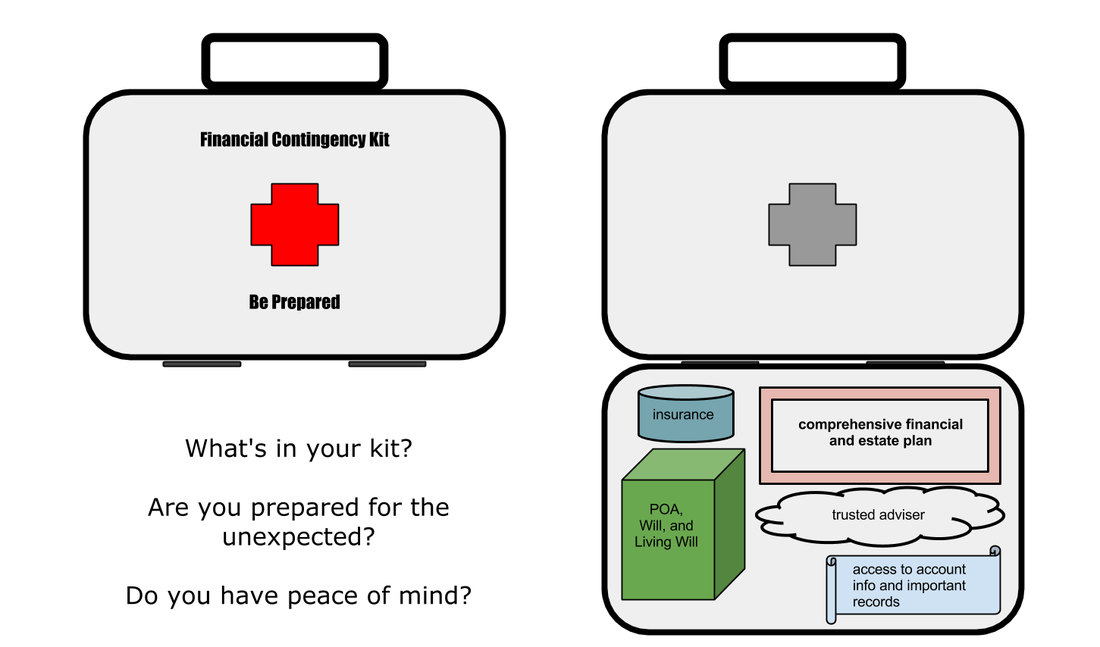

4/22/2013 Financial contingency kitBy definition, the unexpected always takes us by surprise! But there may be ways to lessen the shock and disruption to our lives by taking a few basic steps. Here are a few ideas for building your Financial Contingency Kit:

DRW Financial offers fee-only financial advice and asset management. We act in a fiduciary capacity, and aim to guide clients in the process of creating a comprehensive financial plan that addresses potential areas of financial need. A financial plan may include advice on insurance, investment management, estate planning, retirement income, and charitable giving, among other issues. Please consult an attorney before taking action on legal matters such as wills; consult an accountant on matters of taxes; consult an insurance professional on concerns around insurance policies. Comments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed