|

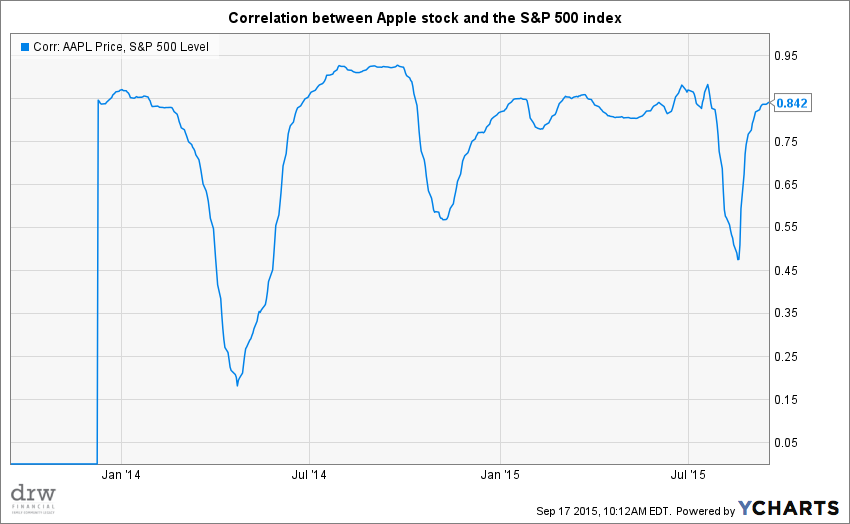

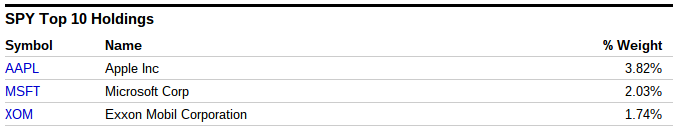

9/17/2015 brief explanation: correlationIn discussions of policy and process, there is a phrase that gets a lot of play: "Correlation does not imply causation". One interpretation of that expression is that just because two (or more) things appear to happen or appear together regularly doesn't mean there is an explicit and clear connection between them. In finance, correlation is about mathOne aspect of the scientific and philosophic approach to portfolio design is recognition that there may be some connections between discrete pieces of a portfolio, and it is important to seek those out and consider their impacts. Keeping this simple: a correlation measure can range from -1 to +1 (Negative 1 to positive 1). A correlation of +1 means that two things move together in perfect lockstep; a negative one means a perfect inverse relationship. Zero, right in the middle, suggests there is no implied or explicit relationship between the two things. In the chart above, the price of Apple's stock appears to be positively correlated with the S&P 500 for much of the last three years. don't assume too muchIn my practice, I try to look at statistical data like this with some skepticism to see if I can understand the underlying connection. If someone finds strong correlation between the height of a population and their preference for lattes over cappuccinos, I may do a little more digging to data manipulation. In the case shown above, however, it makes some sense that Apple and the S&P 500 tend to move together sometimes. For one thing, Apple is a member of that index, so Apple's movement does, itself, contribute to the overall performance of the index. Second, Apple is a disproportionately large contributor to the index. Lastly, Apple is a huge company with a large presence in the US financial markets, and large companies tend, in general, to move in sync with other large companies. zero correlation raises diversityIf the goals for a given portfolio include a need for diversity (and risk sensitive portfolios should), the designer should run some testing on correlations among constituents.

Comments are closed.

|

AuthorDavid R Wattenbarger, president of DRW Financial Archives

June 2022

Categories |

RSS Feed

RSS Feed